Case Study

The most comprehensive neobanking experience in Europe

Vivid Money is taking on Europe’s banking space by storm with an unparalleled neo banking experience for consumers. Packed with features ranging from multi-currency accounts to stock and crypto investments, Vivid makes managing and growing your money effortless. Live in France, Italy and Spain within months after its German launch, Vivid is on a growth trajectory that is second to none.

Challenge

Vivid wanted to address a major issue in Europe’s retail banking space: customers are receiving zero or even negative interest rates on their deposits and all of their efforts to build up wealth were being thwarted by untransparent costs. However, building an entire neobank from scratch in a crowded market with fierce competition and high customer acquisition costs introduced quite a few challenges:

- Vivid needed to focus its resources on product development and marketing to effectively penetrate the market and gain a competitive advantage. However, applying for own banking license and setting up a new banking infrastructure would constrain huge resources and significantly extend the time to market.

- Vivid thus required a licensed banking partner that could stem the regulatory obligations and help Vivid hit the ground running. For the launch to succeed, however, the partner would also need the technical capabilities to cater to Vivid’s wide range of features and speed of execution.

- Further, to outpace the competition, Vivid knew they needed to scale quickly and efficiently. Therefore, the partner needed to accommodate Vivid’s ambitious internationalization plans while maintaining rigorous cost efficiency.

Our solution

All-in-one banking

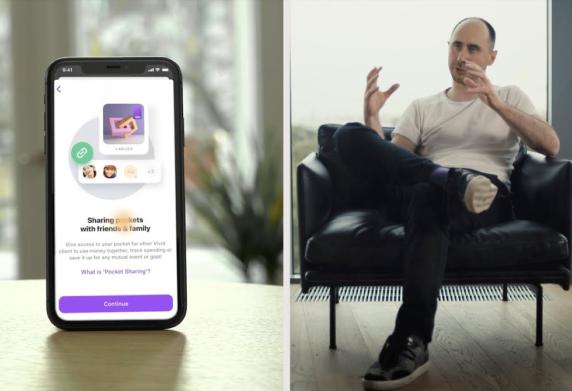

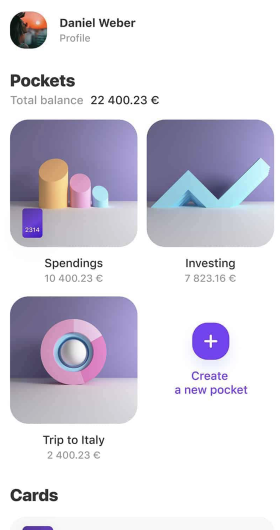

With Solaris as its licensed partner, Vivid got everything it needed to launch a competitive neobank from scratch under one roof. Via Solaris’ Digital Banking API, Vivid can offer its users an numerous sub-accounts, so called “Pockets”, each with their own individual IBAN. With a simple drag-and-drop motion in the app users can instantly link their VISA Debit Card to a Pocket of their choice. Traveling abroad? Solaris also supports multi-currency accounts for Vivid, enabling users to save, spend and withdraw cash abroad in over 100 different currencies at live exchange rates. Users can even open shared Pockets with their friends and families to meet joint savings goals or spending needs. On top of that customers can invest in thousands of financial instruments instantly in just a couple of clicks.

Ultraviolet lightspeed

With Solaris’ simple API-based infrastructure and self-explanatory API-documentation, Vivid could start testing on Sandbox straight off the bat and went live with a fully-fledged neobanking app at an unseen speed. Building on Solaris’ cloud-based Banking-as-a-Service platform, Vivid scaled its customer base to over one hundred thousand in less than one year and over five hundred thousand in less than two years. However, even more impressive than Vivid’s swift launch in Germany was its rapid internationalization campaign. By leveraging Solaris’ ability to passport its banking services to the entire EEA, Vivid went live in France, Italy and Spain just months after its German launch.

Heavy metal

Working together with Solaris meant Vivid retained full control of its unique branding, including the VISA Debit Card. The precious metal card is a guaranteed eye-catcher and comes for free with every account. With the card number, expiry date, CVV and card details hidden away securely in the app, the card doesn’t just look slick, it also offers an unmatched level of security. It’s also rewarding to use – with each payment, users receive cashback in form of Stock Rewards which are linked to popular stocks which help them get started in world of investing.

The project in numbers

Hear what our partners have to say

“With Solaris’ powerful Banking-as-a-Service platform, we found the optimal partner to conquer the European banking market. With its modular approach and an easy-to-integrate APIs, we reduced our time to market significantly and built a competitive offering at scale.”

Group General Counsel of Vivid Money