KYC Platform

The easiest way to identify your customers

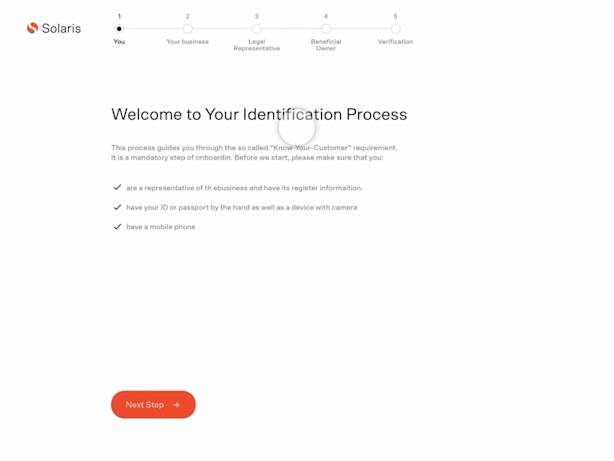

Boost your conversion rates by integrating your sign-up flow with our fully digital Know-Your-Customer Platform, all while staying compliant with EU anti-money laundering laws.

Everything you need in a single API

Our KYC Platform provides you with a multitude of digital identification service components that can be adapted for your organization’s needs. No matter whether you are identifying business or retail customers, our white-label solution integrates smoothly into any web application via API.

Fast and easy identification process that is scalable

Retail KYC

Choose from multiple providers on our platform for optimized digital identifications. With Solaris, you can identify a natural person with just three API calls, greatly simplifying and accelerating your onboarding flow.

Business KYC

Our Business KYC solution reduces the onboarding process of your enterprise customers to less than 48 hours. Using API-based interfaces ensures fast and digital integration of our product while maintaining your look and feel.

Bankident

Boost your KYC conversion rates by integrating Bankident into your sign-up flow. No agents. No waiting lines. Full compliance with German anti-money laundering laws.

VideoIdent

Embed video identification services in your front-end to easily onboard customers. Customers chat with an agent and present their ID documents.

eID

Offer an online authentication procedure that uses the German eID - an electronic feature of the German ID card - and is based on direct two-way authentication between the customer and the provider.

With our RESTful APIs, you gain access to various best-in-class verification methods tailored to your needs.

Talk to usHear what our partners have to say

“What we value most about Solaris is the unique combination of technological expertise coupled with a full banking license. These qualities were paramount in enabling us to jointly set up and implement this project for Otto extremely quickly, while at the same time ensuring legal conformity.”

Managing Director Hanseatic Bank

Your benefits

Digital

Paper-free, fast, and automated. With Solaris’ KYC solutions you can onboard customers in minutes from anywhere in the world.

Experienced partner

As a licensed bank, Solaris understands the challenges and pain points of the KYC process from both a commercial and a regulatory perspective.

State-of-the-art APIs

Our RESTful API is built to scale and provides easy access to our unique identification method as well as third-party providers.

Peace of Mind

Our KYC Platform is fully compliant with anti-money laundering laws and can be adapted specifically to your compliance requirements.