Case Study

SamsungA next-level mobile payment experience

Samsung Pay is one of the most comprehensive mobile payment solutions in the German market, enabling secure, contactless payments with a swipe of a finger on millions of Samsung devices in Germany. Where the user has their home bank account is virtually irrelevant – the virtual Samsung Pay card can be connected to almost every German bank account. What’s more, Samsung Pay comes with the integrated installment feature Splitpay, which lets users convert their Samsung Pay transactions into smaller installments at their convenience straight from within the app.

Challenge

By the year 2020, Samsung had already successfully launched Samsung Pay in 26 countries worldwide, helping Samsung enrich their user experience and strengthening their customer loyalty. By collaborating with a vast number of banks in each respective market, Samsung could settle the payments via the users’ existing credit cards. In Germany, however, where Samsung leads the smartphone market and boasts a multi-million user base, the unique market conditions posed a number of challenges for Samsung’s existing model.

- The German banking market is highly fragmented with a high number of banks. This would result in lengthy and extensive negotiations and technical integrations with each bank before a significant cart-market-share could be obtained.

- Samsung sought a model that was ensuring a competitive advantage and superior featureset, while being commercially sustainable at the same time. Samsung planned to achieve this by becoming part of the value chain for payment-/card products.

- Samsung’s legacy model relies primarily on credit cards. However, credit card penetration in Germany is comparably low and German consumers prefer to pay with a debit card UX. The solution thus required the issuance of a Samsung Pay Card with an additional set of competitive features that was compatible with the Samsung Pay app.

Our solution

Rethinking the debit card

Together with Visa, Solaris developed a virtual debit card in Samsung’s branding that could live in the Samsung Pay app and be linked with almost any German bank account, thereby relieving Samsung of the need to set up individual contractual relationships with dozens of German banks. With this set-up, Samsung can instantly offer a mobile payment experience to almost every Samsung deviceholder, while Solaris conducts the regulated payment flows in the background.

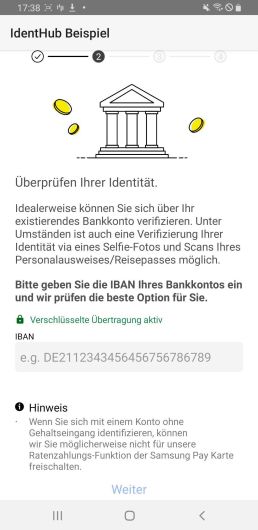

Digital identification at any time

In order to accommodate the high volume of customers opening their Samsung Pay account at once, Samsung also integrated Solaris’ innovative identification method “Bank Ident” – an AML-compliant KYC process enabling the identification of Samsung’s users at any time and place. Instead of verifying the user’s identity at a branch or via a video call, users can simply perform a TAN-approved microtransaction from their existing bank account and confirm their registration with a digital signature. This way, Samsung is able to onboard thousands of customers simultaneously, around the clock.

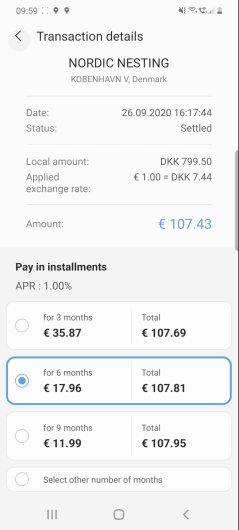

Installment loans at the tap of a finger

Samsung Pay also includes Solaris’ installment product Splitpay: With a tap of a finger, users can convert any purchase over 100 EUR into smaller installments, which are paid back over a period of up to 24 months. Likewise, users can also top up their Samsung Pay card and pay back the prepaid amount in installments. The scoring, risk & arrears management and loan origination for the Splitpay credit line are performed by Solaris entirely automatically, thereby absolving Samsung of the regulatory responsibilities entangled with a lending product.

The project in numbers

- 6Months from idea to go-live

- <1Minute for fastest identification

- 90days after the purchase it can still be split into installments

What they say about us

“In order to enable a seamless mobile payment experience for Samsung’s device holders in Germany, we decided to trust in the proven track record and neutrality of Solaris. The combination of technological and regulatory know-how for a fast and compliant product development has made a lasting impression on us. This comprehensive version of Samsung Pay is a milestone for us for mobile payment solutions internationally.”

President of Samsung Electronics GmbH

Behind the scenes: Samsung Pay enabled

Big Tech meets banking

“Samsung chose us not just because of our tech stack, but also because we cover the full regulatory landscape”

Head of AFC Compliance at Solaris