How pizza sparked an embedded finance revolution

6 minute read

One thing that has driven innovation in the digital world is hunger.

Getting food quickly and easily is essential in today's world. It's not for nothing that "fast food" in all forms is a huge success.

Even the very first online purchase was triggered by hunger.

2024 marked the 30th anniversary of the day a man logged onto an electronic storefront called "PizzaNet" on PizzaHut.com and – according to the pizza brand – made the world's first online purchase: a large pizza with pepperoni, mushrooms and extra cheese.

It's quite surprising that it took another five years before it was possible to buy movie tickets via a cell phone in 1999. A digital payment solution introduced by Norwegian cell phone pioneer Ericsson.

But from then on, things moved faster and faster. And today it's hard to imagine our everyday lives without seamlessly integrated financial services.

Watch the video to learn more about our vision of a world where financial services seamlessly sync with life.

Growing popularity of embedded finance among consumers

In our lives, some embedded financial services have become so commonplace that they are among the most widely used financial tools.

In a recent study by the EHI Retail Institute, 28.5% of online purchases in Germany in 2024 were paid using PayPal, making it the most preferred online payment method. This is a slight increase in market share compared to 2023.

A current report by the Central Bank of Germany shows just how much mobile payments at the point of sale (POS) have become the norm in recent years.

According to the report, mobile payments at the POS tripled in Germany between 2021 and 2023, reaching about 6% of all transactions. Overall, industry forecasts project a compound annual growth rate (CAGR) of 15% from 2025 to 2035, confirming mobile payments as a mainstream payment method.

However, the use of digital financial services does not stop at payment methods.

In all areas, embedded financial services are overtaking traditional offerings, as a study by the German industry association bitkom from 2022 shows.

Interestingly, this study points out that 41% of Germans already use only online banking and no longer frequent a bank branch.

The latest figures suggest that there will be even more "online-only banking" in the future.

When asked where banking processes are handled best, most German respondents chose online banking as their answer.

According to statistics from the German Central Bank (March 2025), about 70% of German banking customers regularly use online banking services – an increase of 14% compared to 2023.

Success formula: Enhanced convenience, seamless integration and trust

Of course, digitization will continue and user behavior will continue to adapt.

But, financial services need some more factors to resonate with customers in the long run, than e-commerce or software products.

At the top of the list for customers is certainly trust in the respective provider – even if the brand of choice only operates the app or website for its core products and works with a banking-as-a-service provider in the back.

In a 2022 survey conducted by Solaris together with the renowned Handelsblatt Research Institute on the use of embedded financial services in the mobility industry, the main result was the following:

The higher respondents rated the safety and reliability of a mobility brand, the greater their willingness to use a financial product from that brand. In all four markets surveyed (Germany, France, Italy, Spain), the acceptance rate was always well above 30%.

Outlook from Solaris and Roland Berger: The promise of embedded finance

In 2023, Solaris conducted a survey on consumer behavior with regard to embedded financial services in the four largest markets of the European Union together with the management consultancy Roland Berger.

The survey set a strong base by valuing Europe’s embedded finance market at just over EUR 55 billion and forecasting it to more than triple by 2028. It highlighted that integrating financial services into everyday platforms can transform customer experiences, while also noting challenges around trust, regulation, and technology adoption.

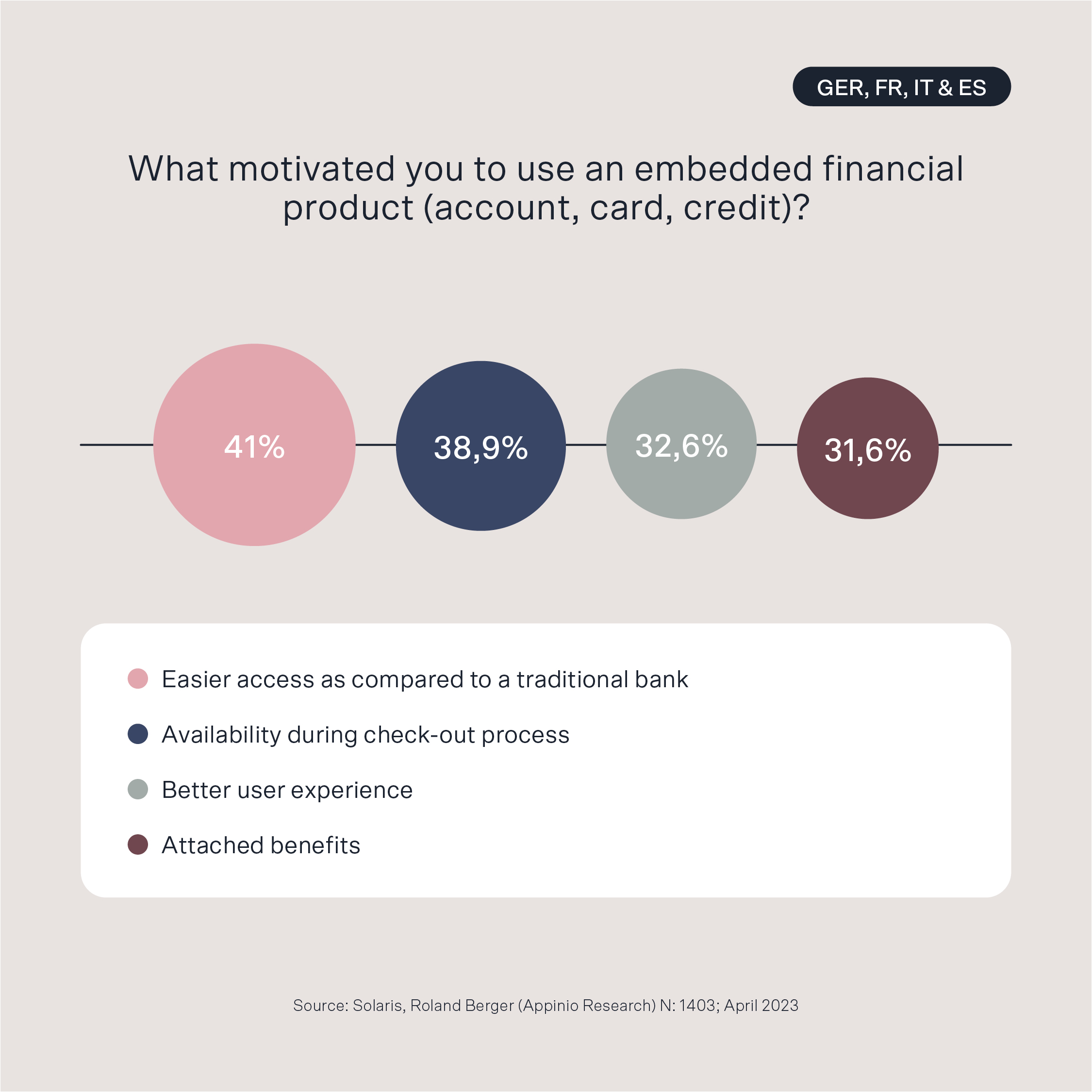

Consumer behavior insights showing demand for accessibility, convenience, and trust

Across Europe’s four largest markets, 41% of participants cited easier access to financial services than traditional banks as their primary reason for using embedded finance.

This finding shows that accessibility has become a key driver in the digital financial landscape.

Next, 38,9% of respondents pointed to the availability of embedded financial solutions at checkout as a major factor, reflecting the widespread normalization of services like buy-now-pay-later (BNPL) and digital payments in e-commerce.

Convenience remains a priority. In fact, 32,6 % pointed to an improved user experience as a reason for adopting embedded financial products, a factor relevant not only in B2C but increasingly in B2B markets as well.

But above all, checkout must be convenient and fast.

Andreas Simonsen, Director of Commercial at Solaris, points out:

"This shift in expectations reflects a deeper change in how brands approach financial services. Our partners don’t just integrate financial services, they design better user experiences. By enabling smarter use of customer data, embedded finance helps brands build loyalty and deepen engagement. Embedded finance isn’t a feature anymore, it’s a product advantage."

For example, Finom – a one-stop-shop platform for banking, invoicing and expense management for entrepreneurs and SMEs – is entirely focused on developing the best UX for its business customers. In doing so, the company is very successful and combines financial services from different providers on its platform, from bank accounts to tax calculation.

On the way to a cashless age

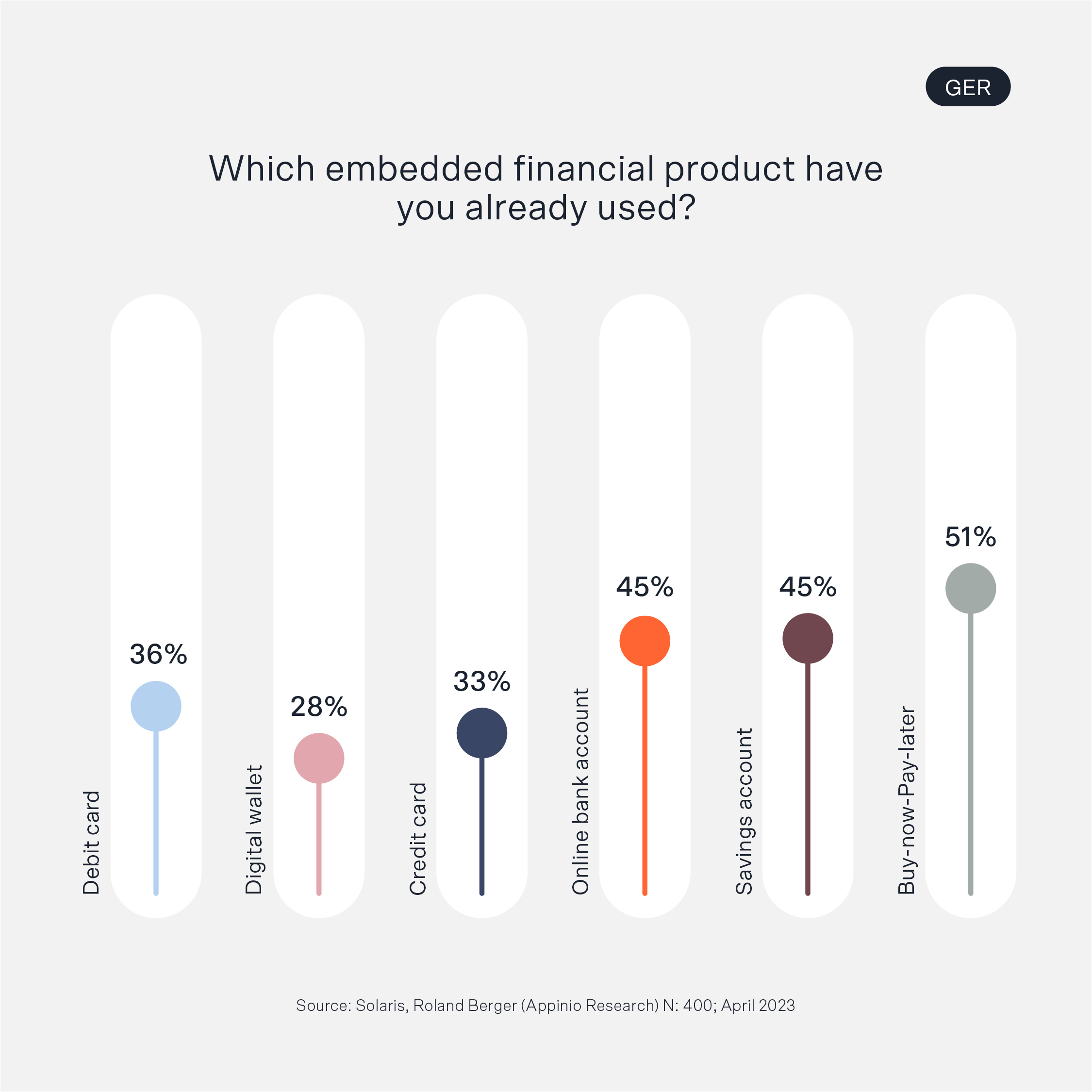

The rise of cashless and cardless payment methods was prevalent among the types of embedded financial services currently used by consumers.

Debit cards are now used by a high proportion of people everywhere in Europe. With a usage rate of 39%, they are the preferred financial tool in our survey.

Surprisingly, the use of digital wallets comes in second place at European level. A high proportion of 36% of respondents said they use a digital wallet. This puts its use ahead of that of credit cards (34%) and online bank accounts (28%).

Respondents' reactions to the use of BNPL offerings varied quite a bit across the markets we surveyed.

While BNPL was mentioned by 18% of respondents across Europe, it is by far the most popular embedded financial service solution in Germany, recognized by 51% of respondents.

This is consistent with the findings of a recent study by Research and Markets, which indicates that Germany is one of the most important markets for BNPL in Europe.

When asked about the use of embedded financial solutions in e-commerce, a whopping 58.9% of German respondents answered that they had used BNPL at least once.

This is evidence that partnerships with fintechs can help e-commerce skyrocket growth. Cart abandonment and churn rates can be reduced with integrated BNPL.

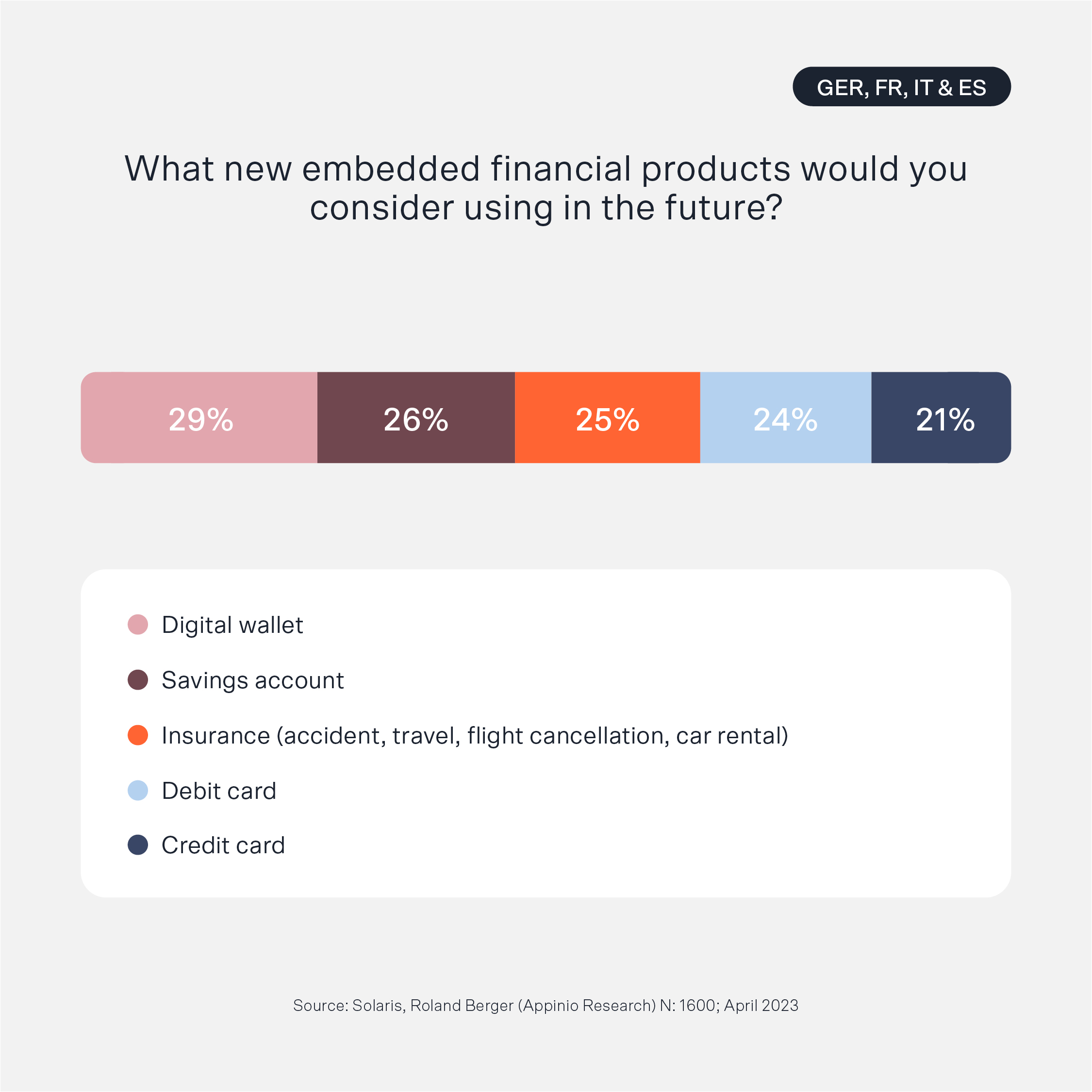

Customers focus on saving and safety

It should not have escaped anyone's notice that interest rates for savers have been returning since the beginning of 2023.

Savings accounts are therefore high on the list of planned uses for digital bank accounts. On average, 26% of respondents want to use a digital savings account in the future.

It is not only the Germans, who are known for their thriftiness, who want to use a savings account; in France, most users (30%) are willing to deposit their money for a longer period of time.

A result that surprised us: Insurance is high up in our rankings. On average, 25% of respondents plan to take out new insurance policies in various areas.

Of course, with the rise of digital insurers, buying insurance has naturally become much more convenient for customers.

Today, it's easier than ever to get the best possible insurance coverage on the best terms. As the example of Clark shows, which has risen to unicorn status in a very short time with its alternate model.

If the respondents' statements are interpreted as a willingness to switch to digital insurance offerings, insurers should be very attentive.

And partnerships with fintechs will create new opportunities for insurers. Above all, greater transparency and customer friendliness will cause upheaval in the coming years.

Embedded finance in 2025: Surpassing expectations

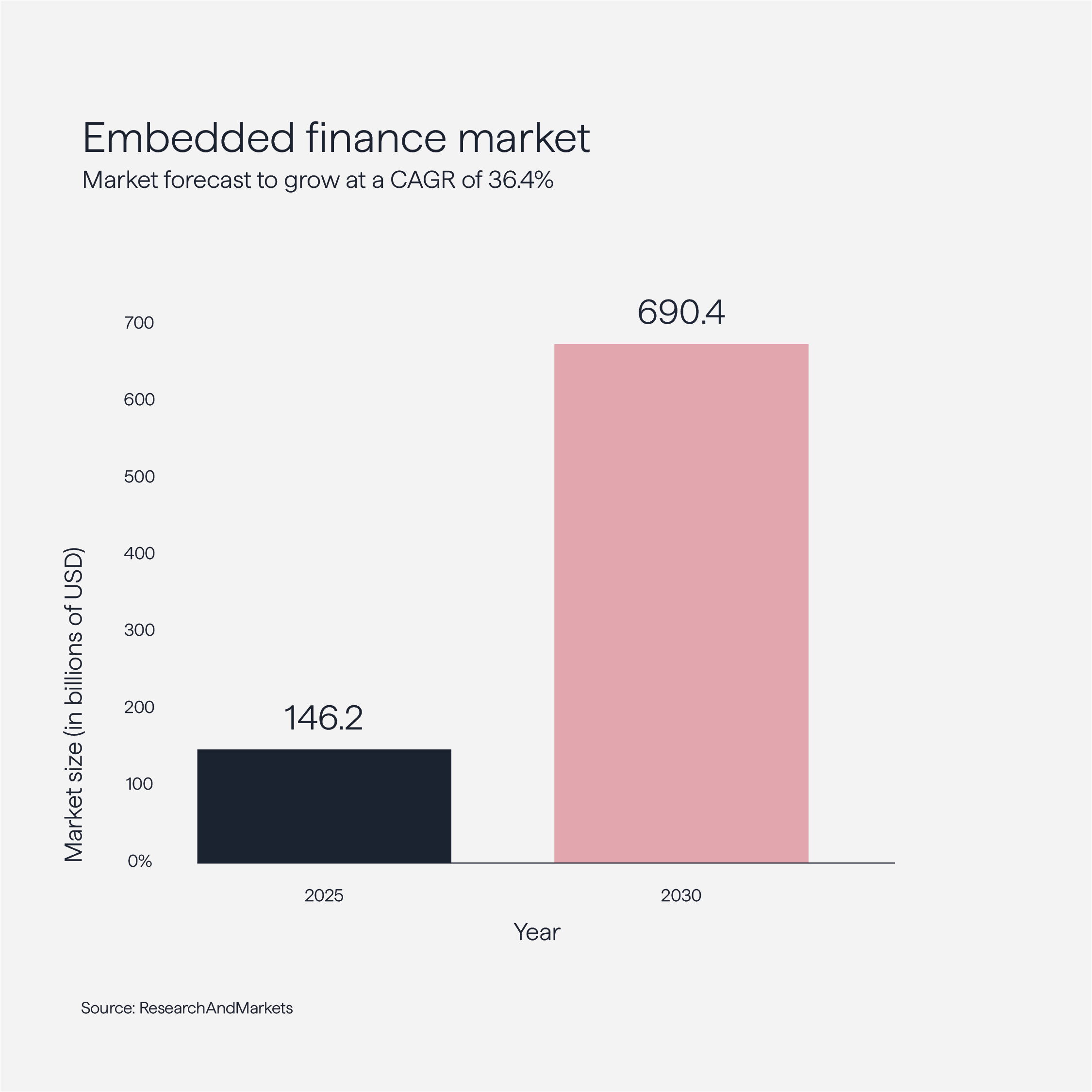

A recent forecast from Research and Markets highlights a much faster and broader market expansion than initially expected. The global embedded finance market is projected to grow at a compound annual growth rate (CAGR) of 36.41%, increasing from USD 146.17 billion in 2025 to USD 690.39 billion by 2030.

This rapid growth is driven by increasing consumer demand for digital and convenient financial services, technological advancements enabling seamless integration between financial and non-financial platforms, and the rising adoption of embedded payment solutions across various industries.

The report also emphasizes that consumers' growing willingness to use integrated financial services, combined with the rapid expansion of online platforms such as e-commerce, are key factors propelling this growth.

Embedded finance is a business must-have

Embedded finance is no longer a niche innovation but a strategic necessity for businesses aiming to enhance customer loyalty, improve conversion rates, and unlock new revenue streams.

The convenience of accessing payments, credit, and insurance products directly within platforms, without redirecting users to traditional banks, is reshaping the financial services landscape. While a Roland Berger survey previously identified embedded finance as a transformative opportunity, the latest 2025 data confirms that the market is evolving more rapidly and comprehensively than originally projected.

Supported by regulatory frameworks like PSD2 and emerging initiatives such as Financial Data Access (FIDA), embedded finance is becoming a core pillar of both European and global financial ecosystems, driving sustained growth and innovation.