Breaking down barriers: Creating inclusive financial services

5 minute read

Are financial services products really taking the unique needs of women into account?

While no financial services business would deliberately set out to put off women — half the world's population, a significant customer segment — the reality is that, despite assurances of gender neutrality, they all too often miss the mark. And women, particularly those from minority backgrounds and the LGBTQIA+ community, struggle to access products men take for granted.

Futura – Solaris’ network for women wanted to find out what women and non-binary people want from financial services and spark meaningful conversations that lead to real and lasting change.

In 2023, Solaris conducted a survey of 221 women and two non-binary individuals, and qualitative interviews with four trans* women and five women with a migration background, in conjunction with ACI Diversity Consulting.

While the results aren't representative — nor do they aim to be, since women are such a highly diverse group of individuals — they provide qualitative evidence of current attitudes, and a starting point for future research on the barriers women face when accessing financial services products.

But what makes them especially significant is that the majority of our respondents work in financial services and, so, have above-average knowledge of the industry's workings and the products that are available to them.

Which means women who aren't involved in the industry or have average or below-average financial knowledge likely find navigating financial services even more challenging.

So, what steps should financial services businesses be taking to make sure they're actually walking the walk when it comes to inclusivity?

Understanding barriers to access: areas for improvement

Our survey results uncovered three key issues in financial services that are holding women and non-binary people back: a disempowering financial knowledge gap, unconscious bias, and systemic issues.

The financial knowledge gap

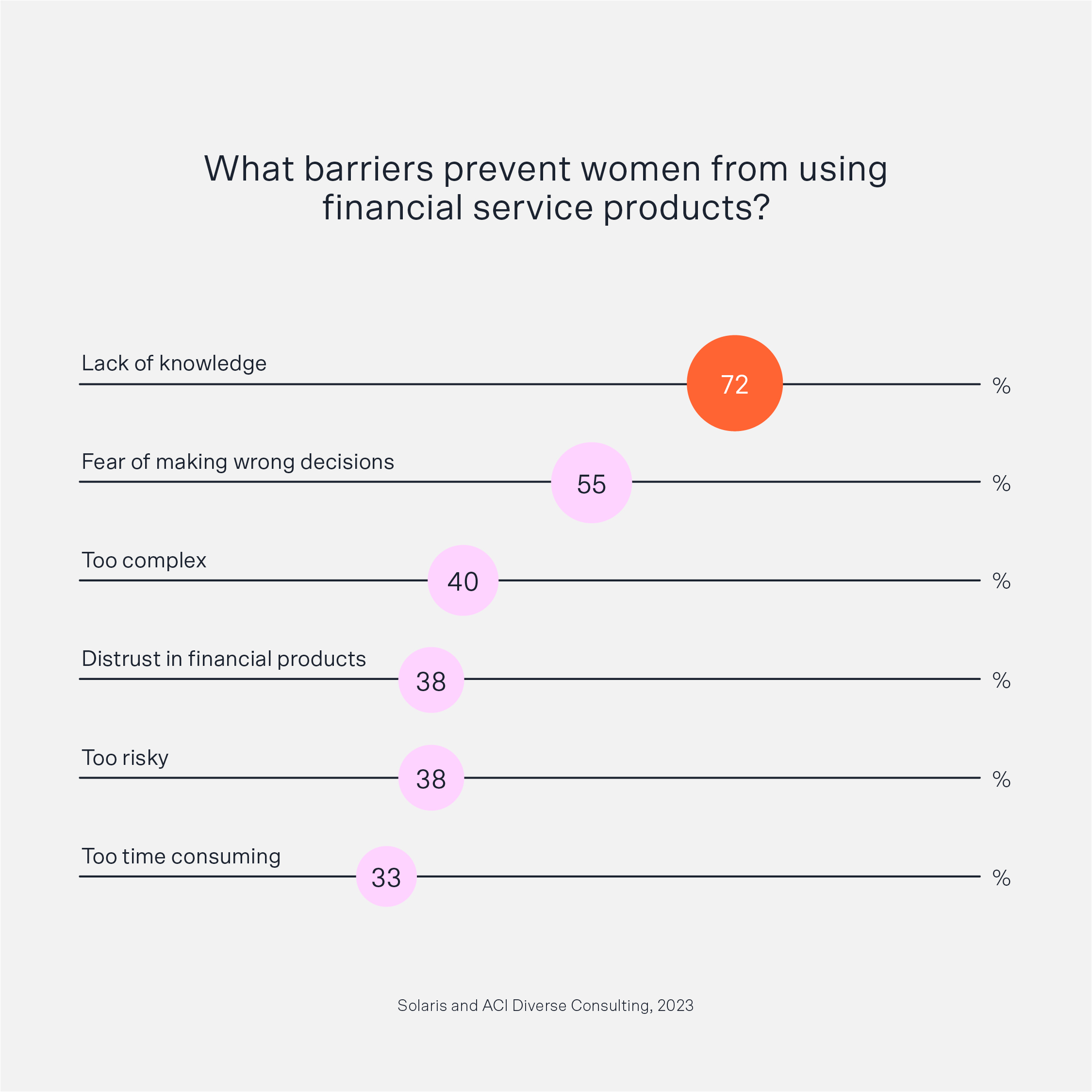

71.28% of respondents told us they don't feel knowledgeable enough about financial services products, to the point where some don't even know where to start looking for information.

The key reason for this seems to be a lack of easily accessible educational resources or people they feel comfortable turning to for help. 24.10% of respondents told us they wished they had more guidance and support. And 20.51% linked low use of some financial products, particularly investments, to an absence of easy-to-understand literature and touchpoints in their everyday lives.

This knowledge gap is making it harder for women and non-binary people to make informed choices about their financial health and well-being. Worse, it's creating fear and mistrust. 54.87% of respondents told us they worry they'll make the wrong decision and lose money as a result, while 37.95% are suspicious of financial services providers.

Unconscious bias

Gaps in financial knowledge become an even more significant problem when you take respondents' background into account.

Respondents from a migration background told us they find it challenging to understand product literature, because it's typically packed with obscure jargon and formal language.

But solving the issue isn't as easy as picking up the phone.

If anything, speaking to an advisor can make matters worse. Respondents from a migration background reported being asked patronizing questions, like whether their husbands allowed them to open a bank account.

Trans* respondents similarly feared they wouldn't be taken seriously. And they were also concerned they'd be misgendered or dead-named (called by the name they used before transitioning). We were even told of instances where advisors hung up because their voice didn't match how they presented. Unsurprisingly, our trans* respondents were the least likely to use financial services. Only 60% told us they use a bank account or a debit card, while even fewer use credit cards or own ETFs — 40% and 20% respectively.

"I think that's outrageous," says Hülya Buchwitz, a Futura Core Team Member, "We should be talking about this, and the reasons for it, much, much more…"

The wider picture: systemic inequality

You don't need to dig too deep to see how financial services products make women feel excluded.

"German is a very gendered language, so things like legal documents aren't inclusive," says Hülya Buchwitz "It's easy to dismiss this as being just 'the legal stuff' but it all adds up. It's important for people to feel like a document is addressing them."

Similarly, billboards, brochures, and other marketing materials all too often default towards depicting men in powerful poses, which reinforces the idea that finance is a man's domain.

But while these are the most obvious examples of how financial services businesses get it wrong, they're far from being the only issues.

More significantly, structural inequalities such as the gender pay gap, the gender pension gap, and the gender credit gap mean many women aren't eligible for products most men take for granted, creating a vicious cycle.

"In my previous career in social work, the topic of financial independence came up all the time," says Hülya Buchwitz. "If you're a stay-at-home parent, or you work part-time so it fits around your childcare responsibilities, and all your bills are in your husband's name, it gets harder and harder to change your circumstances over time.

"Not only do you not have money to begin with… you also don't have the opportunity to create wealth. So you're stuck."

What women want: 3 steps to greater inclusivity in financial services

So how can financial services businesses address the issues that are holding women and non-binary people back and make their products more inclusive?

For 85.42% of our respondents, the crucial first step is a bigger push towards financial education. And the earlier in women's lives this begins, the better.

A 2018 study found that our understanding of money and attitudes around saving and spending are set by the time we're 7 years old. So, the sooner children start developing their money skills, the greater the likelihood they'll have better money habits later in life.

This doesn't have to be a formal affair, either. It can be as simple as integrating the process into your app's user journey.

Digital-first investment platform Beatvest, for instance, has gamified the process. The user can increase their investing knowledge as they grow their portfolio, and even practice using fictitious money, so they can build their confidence before committing their savings.

Just as important, discussions about money — which are still all too often taboo, especially among women from minority backgrounds — need to be encouraged.

This is one of the reasons why we started holding Futura workshops.

"I've seen many attendees at our workshops experience an A-ha! moment when they hear others speaking about their experiences," says Hülya Buchwitz. "It helps to know there are others in your same situation. That you're not alone."

Second, financial services businesses need to make more of an effort to understand women and non-binary people's needs and circumstances and make sure their products address them.

It's true. Issues such as parental leave and the fact that women typically take on the bulk of caring responsibilities need to be addressed through systemic change. But, in the meantime, financial services businesses shouldn't act like they don't exist.

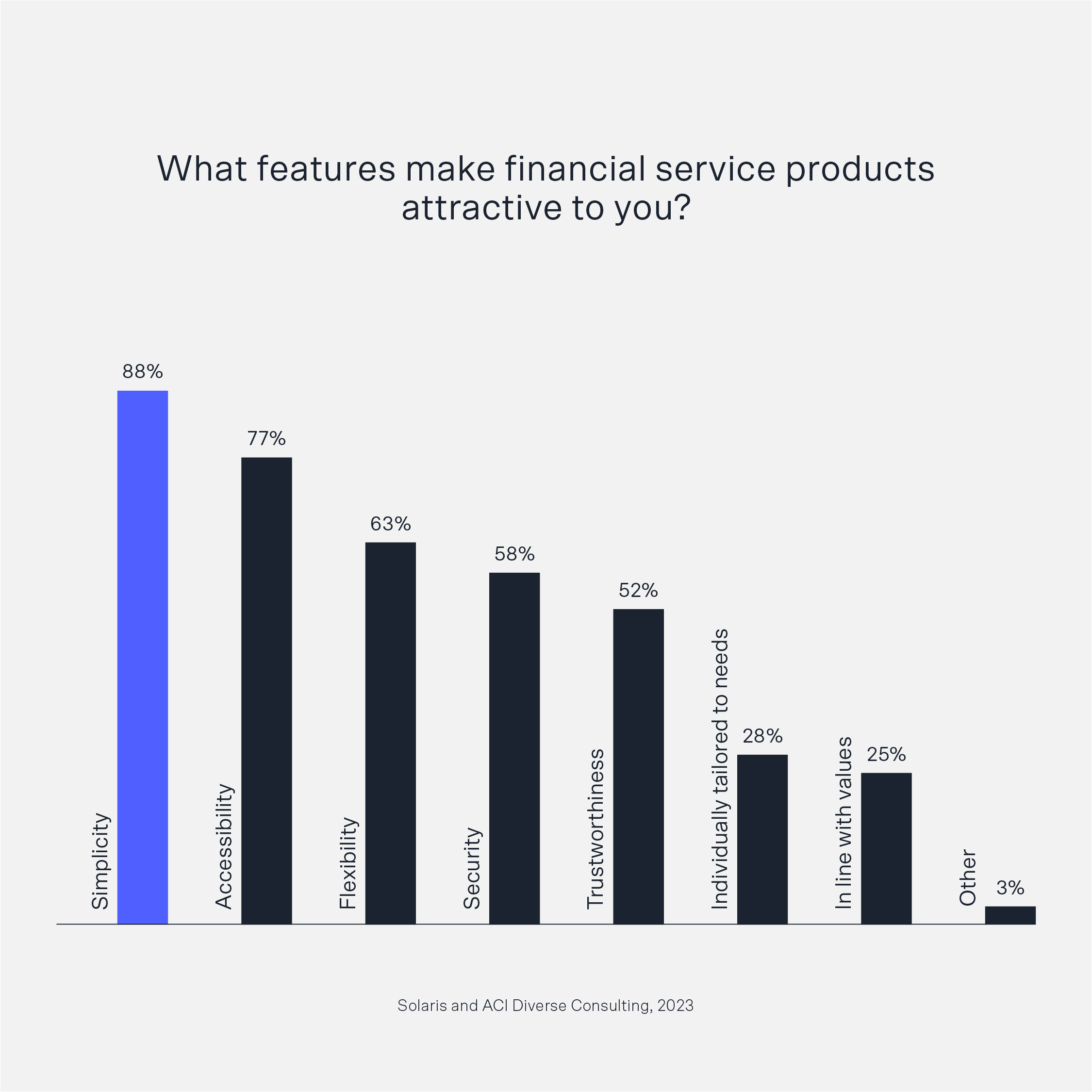

Products should enable women to suspend payments and get support in case of a career break. They should prioritize long-term security — a deciding factor for 57.69% of our respondents when choosing a financial services product. And they should be easy to use: clear language, a minimal learning curve, and, for investments, transparency around where the money is going, so women can make sure it aligns with their values.

Thirdly, it's high time financial services businesses took representation seriously. And not just in marketing.

Women — particularly those from a minority background or who are trans* — and non-binary people often report feeling disrespected or even unsafe. Being able to speak to staff from similar backgrounds and, so, who can better understand their circumstances would go a long way towards making them feel more accepted and included.