What the hell is Banking as a Service? And what is it not?

5 minute read

With the surging number of new banking and fintech business models emerging on the scene, it can be hard to keep them all apart. The term “Banking as a Service”, especially, still has many scratching their heads. But scratch no more! We’re here to guide you through the jargon jungle of the new banking business models in our complete overview. We will cover:

- Banking as a Service

- Open banking

- Platform banking

What exactly is Banking as a Service?

The best way to explain Banking as a Service is by means of an example. Imagine for a moment that you are the manager of an airline. You are facing stark competition and you would like to strengthen your customer loyalty. If you could offer your customers, say, a debit card, you could award them loyalty points whenever they pay with their card. Then, each time your customers use their card, they would interact with your brand. By analyzing your customers’ spending behavior, you could understand them better and offer them more tailored services.

Or what about if you could offer your customers an online loan for their flight tickets directly on your website? This way, your customers could finance their holiday without ever having to interrupt their customer journey. You could increase the number of flight tickets you sell and directly influence the amount your customers spend. A loan also represents a much closer customer relationship with far more touchpoints than just a single sale.

There are dozens of ways of how non-banks can improve their customer experience and boost their revenue by offering their own banking services. However, if you want to offer banking services, effectively every government in the world requires you to own a banking license. And due to the systemic relevance of banks to the functioning of the economy, such a licence is difficult to obtain. Acquiring a licence imposes not only significant capital requirements, but more importantly compliance with strict regulations on money laundering, banking secrecy and deposit protection, to name a few. This is where Banking as a Service comes in.

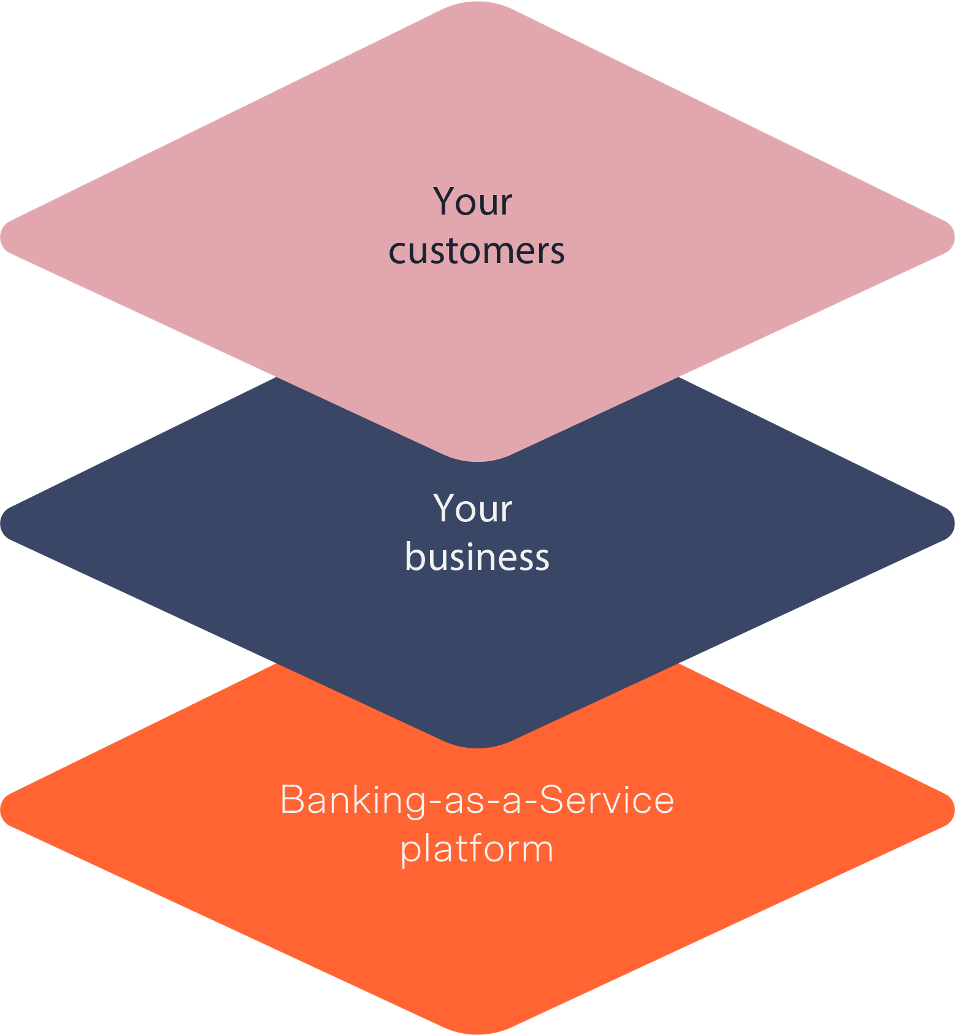

Banking as a Service (or BaaS for short) describes a model in which licensed banks integrate their digital banking services directly into the products of other non-bank businesses. This way, a non-bank business, such as your airline, can offer their customers digital banking services such as mobile bank accounts, debit cards, loans and payment services, without needing to acquire a banking licence of their own.

The banks’ server communicates via APIs and webhooks with that of the airline, enabling your customer to access banking services directly through your airline’s website or app. Your airline never really touches the customer’s money, it acts simply as an intermediary, meaning it is not burdened by any of the regulatory duties a bank has to fulfil.

Thus, with BaaS, pretty much any business can become a banking provider with nothing but a few lines of code. That’s why BaaS is also often referred to as white-label banking, since the banking services are delivered through the branded product of the non-bank. Next to solarisBank, other providers in Europe’s growing BaaS landscape include ClearBank, RailsBank and Starling Bank. Across the pond, established banking giants are also launching BaaS projects next to their existing offering, such as BBVA in the US.

So, Banking as a Service is the same as open banking?

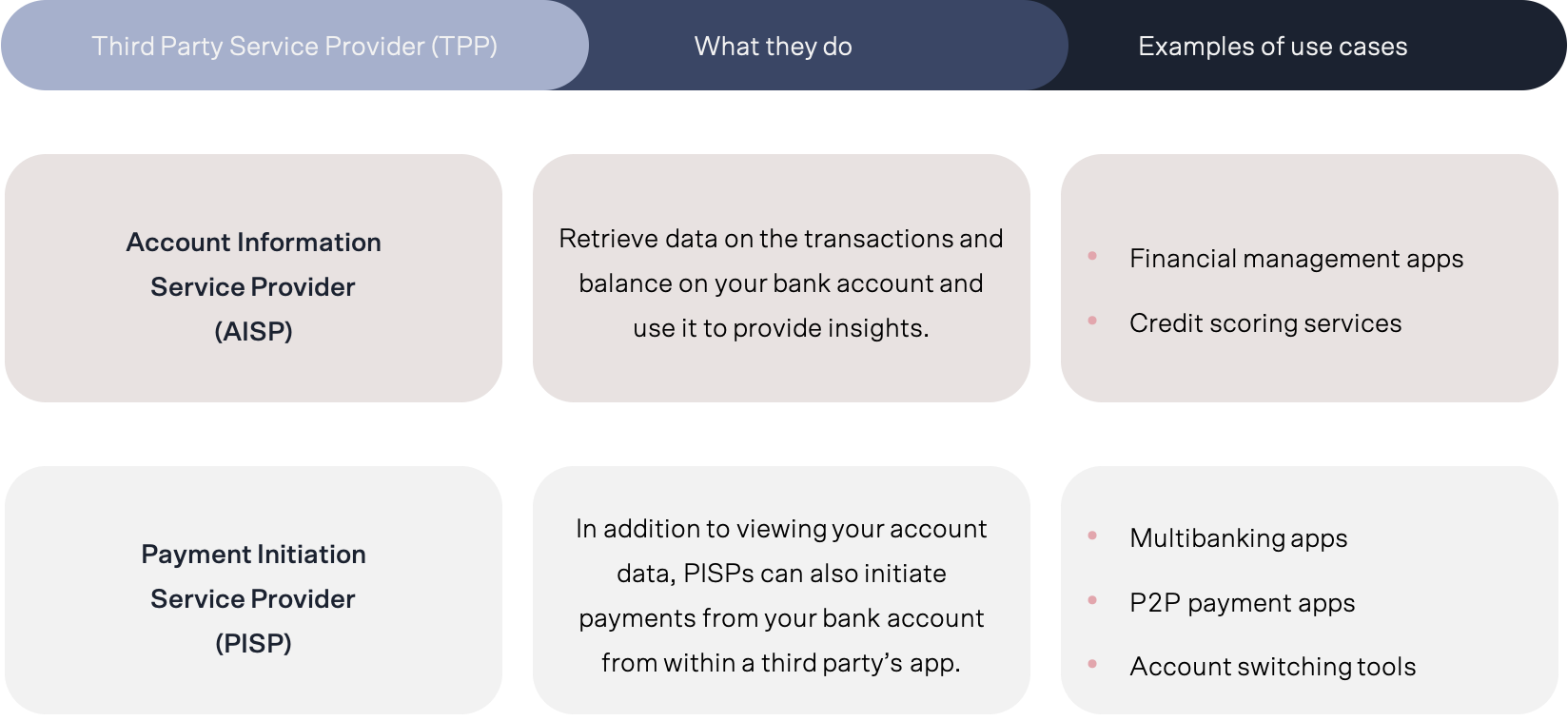

No, not really. The two models often get confused, as open banking also involves banks connecting to non-banks via API. However, the models serve entirely different purposes. In BaaS models, non-bank businesses integrate complete banking services into their own products. In open banking models on the other hand, non-bank businesses merely use the bank’s data for their products. In the industry, these non-bank businesses are called third party service providers (TPPs).

Let’s look at an example. Financial management apps are prominent TPPs that benefit from open banking. They aggregate information from all of your different bank accounts into one application, enabling you to better oversee your finances. This can help you achieve savings goals or improve your spending habits. In order to aggregate the information, the app needs to draw transactional data from all of your bank accounts. It does this via an API integration to the banks’ systems.

Often, this API integration will be provided by yet another party. They are generally categorized as API banking platforms, and can be considered as the middle men connecting the banks with TPPs like the financial management app. They provide the actual API layer that sits on top of the bank’s system that enables the flow of data between the bank and the TPPs. Prominent examples in the German market include players like finleap connect, Ndigit and Fintecsystems.

There are many other use cases for open banking. The second EU payment services directive that came into action on the 15th of September 2019, better known as PSD2, makes it mandatory for banks to open up their data to third party service providers, with the intention of proliferating these use cases. We’ve summarized the main TPPs and use cases for you below. Warning - acronyms ahead!

Pretty neat stuff. The key thing to remember though, is that different to BaaS providers, the TPPs are not able to perform banking services (such as lending or taking deposits), as they don't hold full banking licences themselves. They are simply repurposing account information from your existing bank accounts to provide insights or trigger transactions.

OK, understood. And what about platform banking? Where does that fit in?

Platform banking is a different story altogether. This refers to banks that integrate services from other fintechs to augment their existing offering. So, for example, a bank might integrate a robo-advisor into their app to enable their customers to access investment products from the same account from which they do their day-to-day banking. Platform banking can thus be described as the inverse of Banking as a Service. In the platform banking model, the bank owns the customer and integrates services from fintechs. In the BaaS model, the customer is owned by the fintech/non-bank and integrates services from the bank.

Banks often use the platform banking approach as a defensive strategy to prevent losing their customers to savvier fintechs. By integrating the fintechs’ services into their platform, they can at least keep their customers in their ecosystem, even if it means handing over the lion share of the revenue to the fintech.

And there we have it. We hope we could shed some light into the potpourri of technical terminology and business models in the evolving banking and fintech world. Still, this is just a snapshot of a slice in time. The banking landscape is in continuous flux with new innovators constantly stepping on the scene. So, watch this space to stay up to date on industry developments and to hear our opinions on them.

For your reference, here is a short summary of the models covered in the article above:

Banking as a Service Providers

- What it is: licensed banks that enable other businesses to integrate digital banking and payment services directly into their own products.

- How it works: the business’ frontend is connected to the BaaS provider via API, allowing the business to offer digital lending services, account management and payment services themselves in their own apps and websites.

Open banking providers (a.k.a third-party service providers)

- What it is: non-banks that access data from their customer’s bank account to provide account insights or trigger payments from within an app or website.

- How it works: the open banking providers connect to the bank’s system via API to retrieve the data. Often, the API layer between the bank and the open banking provider is provided by an API banking platform.

Platform banking

- What it is: banks integrating services from other providers, mainly fintechs, in order to offer their customers a broader range of financial services from one bank account.

- How it works: depending on the type of set-up, the fintech’s services are usually fully integrated into the bank’s app/webpage user interface via API.