These banks are outperforming everyone

4 minute read

Not only are automotive banks of systemic importance to Germany’s economy, they actually outperform each and every one of Germany’s traditional banks. What makes these banks so incredibly successful, and why do we consider them to be the pioneers of contextual banking?

To understand the success of automotive banks, we must first take a step back; specifically, back to 1926. That was the year the Ford Credit Company was founded in Berlin by Henry Ford, Germany’s very first bank that was owned and operated by a car manufacturer. Back then, automobiles were unaffordable for the majority of German consumers, and traditional banks were unwilling to finance them. Ford set out to change that, and in doing so, brought one of banking’s greatest innovations to Germany: contextual financing.

Fast forward to today. Since the Ford Credit Company started financing its first cars in Germany, the market for automotive banking has matured into a growth market of vital importance to the national economy. Today, over 75% of all newly registered cars that roll onto the tarmac each year are financed by automotive banks, corresponding to an impressive annual credit volume of around 60 billion euros.

In fact, automotive banks are among the most successful banks in Germany today. In 2017, neither Deutsche Bank nor ING could measure up to Volkswagen Financial Services, which topped the list with earnings before tax of 2,46 billion euros. This may come as a surprise, but it’s not an anomaly. Second in line with an EBIT of 2,0 billion Euros that year was the Mercedes Benz Bank.

An indispensable part of the value chain, automotive banks have become decisive for the profitability of manufacturers and retailers alike, with financing, leasing, insurance and other financial services making up a third of the added value generated.

But what makes this banking model so successful?

The key difference between traditional banks and automotive banks is the nature of their customer relationship. The consumer wants to buy a car — not a loan. The loan is simply a means to that end. Getting both the car and the financing out of one hand gets the consumer to his goal quicker and with less hassle. That is the key benefit behind contextual finance. Integrating financial services directly into the product creates a seamless customer experience with no interruptions.

Simultaneously, by offering the option to finance the car, the manufacturer benefits from both the resulting sales boost and the additional interest revenue. In times of market volatility, the option to subsidize sales with financing can also act as a buffer to bridge periods of lower demand.

Aside from its function as a sales support, offering financial services also massively increases customer loyalty. KPMG studies show that customers that finance their car through the manufacturer are up to 45 percent more loyal to the brand, buy new cars more regularly and spend about nine percent more on their car than customers that pay “cash”. With a one-time payment, the purchase of the car marks the first and last customer touchpoint. If the car is financed by the automotive bank, each loan repayment represents a customer touchpoint that the manufacturer can use to bind the customer to the brand and leverage cross-selling opportunities. Thus, the products of the automotive bank accompany the customer along the entire life cycle of the car and can range from car insurance, leasing, service packages and warranty extensions to credit cards and savings accounts.

As the digitization of mobility progresses, automotive banks are at a pivotal point: whilst there are many new revenue streams to unlock, there are challenges waiting too.

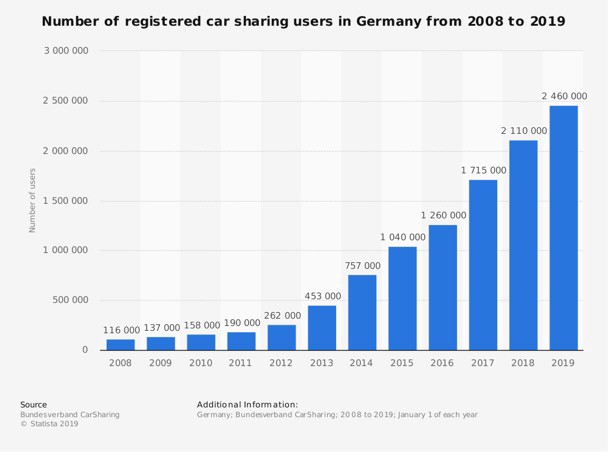

With both banking and mobility being heavily impacted by digitization, automotive banks are under pressure to adapt to new customer demands if they want to retain their unique position in the market. Especially in metropolitan areas, car sharing models with manufacturer independent fleets are becoming an increasingly popular mobility concept. In Germany alone, the number of carsharing users has doubled in the last three years to almost two and a half million (Figure 1). There is a big chance for automotive banks to benefit from this trend by financing, insuring and managing these fleets. This will, however, require automotive banks to complement their existing business with service-based models that enable on-demand, digital payments. For the shift from fixed monthly rates to usage-based, flexible rates to take place, new technology and sales channels are required.

An additional challenge for automotive banks is that car sales themselves are also moving away from the offline sales channels at the dealership down the road and into online direct sales, as can already be observed in marketplaces for used cars. In their next stage of innovation, automotive banks must evolve to become an all-round financial service provider for the mobility customers of the future. From wholesale and retail financing and insurance of the car, to the pay-as-you-go service for sharing one, to mobile bank accounts with loyalty benefits connected to mobility: automotive banks can lodge themselves between each and every one of these links of the car’s value chain.

Automotive banks — a banking blueprint for the future?

Automotive banks are a prime example for how contextualizing banking services by embedding them within another product can create immense value that traditional banking services could hardly unlock. Looking ahead, automotive banks can demonstrate how vast the potential of contextual banking is in the digital age, where having frequent and easily accessible customer touchpoints at the touch of a button is increasingly valuable. The success of automotive banks serves as a model for countless other industries that have customers with specific needs and requirements. If you can manage to embed financial services into your product, the opportunities are manifold.

Want to find out more about solarisBank and how we are enabling the future of financial services? Have a look at our website: https://www.solarisbank.com/en/