solarisBank x Money 20/20 Europe 2018: our takeaways

4 minute read

solarisBank was one of many companies attending Money 20/20 Europe this year, which took place from June 4–6. Money 20/20 is a top-rated three-day conference focused on the future of money, attracting global leaders from banking, finance, payments, and fintech. This year was the first year Money 20/20 Europe took place in Amsterdam, after being held in Copenhagen previously. Global branches of the conference are also held throughout the year in Asia, China, and the U.S.

The solarisBank team made the most of the conference, attending numerous panels and meeting a plethora of people over the course of the event. After three days of exciting discussions, one thing is clear: it’s interesting to see what comes together when we talk about the future of money. Check out some of the most noteworthy topics in our shortlist below!

The team next to the solarisBank Speaker’s Lounge

Open banking: higher collaboration between banks, fintechs and major financial players

Open banking was one of the most discussed topics at the conference. No surprise, since the European Payment Service Directive 2 (PSD 2) finally came into force in January this year. Many big banks and financial players mentioned their current approach to open banking and their active role in contributing to a wider financial ecosystem. This was a marked shift in the way banks spoke about partnering with other companies and third-party service providers when compared to previous year’s conference. Last year we saw banks talk about financial inclusion, building digital products to meet consumer demand, and how to retain customers in today’s competitive banking environment.

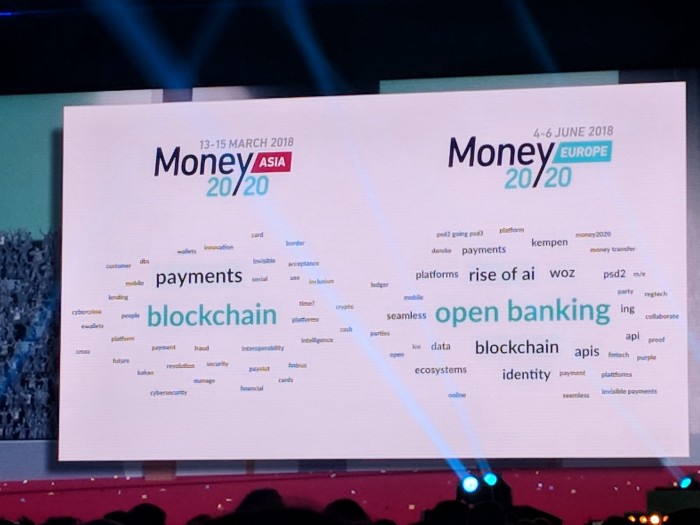

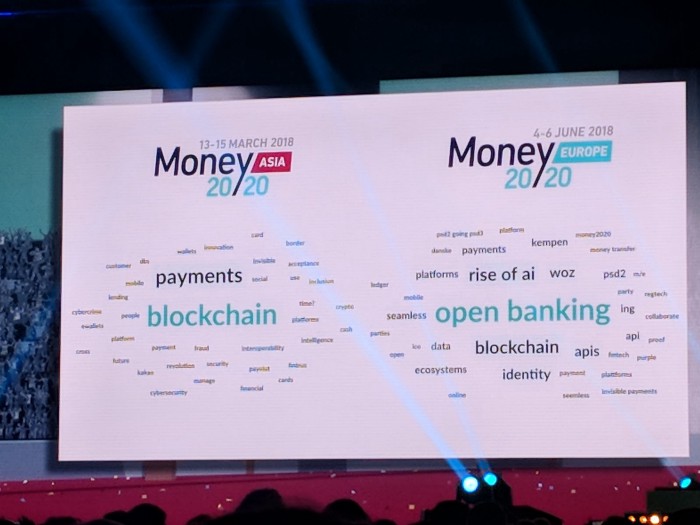

The most discussed topics of Money 20/20 Asia and Europe 2018

ING’s CEO Ralph Hamers sat down with 11:FS Co-founder David Brear and gave some insights about his keynote on open banking–

“Given the fact that people spend more and more time (and also corporates) in digital worlds than in the physical worlds meeting each other, you have to make sure that you are either connected to some of those platforms out there, or you have to become a platform yourself. And if you want to be a platform yourself, you have to be open.” Charlotte Hogg, CEO Europe of VISA, also mentioned in her keynote how VISA is increasingly collaborating with fintech companies in 2018, including recent investment in solarisBank.

“We’re a network that is open, reliant on partnerships, and we have the reach and acceptance and brand that we bring together.”

Keynote from Charlotte Hogg, CEO Europe of VISA

The topic of open banking also extended to the discussion on APIs and their integration into financial platforms, as in the “Rise of the Planet of the APIs: Data Centricity” panel our CCO Marko Wenthin participated in. Speaking with payments and lending industry front-runners Hiroki Takeuchi, (GoCardless), Henrique di Lorenzo Pires (Klarna) and Christoph Rieche (Iwoca) and moderated by Shamir Karkal (Omidyar Network), each participant shared valuable insights about the use of APIs in their business models and how their data collection process is affected in a post-PSD2 world. Marko gave insights into solarisBank’s API integration, stating, “Building a platform without APIs wouldn’t work. To create our ecosystem, we aim to provide the most simple endpoints to connect providers as well as business clients.”

Identity

Lots of focus at this year’s conference was on identity. One of the most interesting talks took place between iSPRT Foundation’s Fellow and Head of Developer Ecosystem, Nikhil Kumar, and Lydia Glyptis, Chief Innovation Officer for Qatar National Bank. The two discussed how iSPRT created the first digital provider in India to give out unique digital identifier numbers to citizens, in part to help India’s largely underbanked society. He elaborated on how building further elements of their project India Stack has given more citizens access to basic human necessities like banking and healthcare.

One quote especially resonated with us: when asked how he keeps the information they require from individuals to a minimum during registration, Kumar answered, “Any information that comes into our registry needs to be verified. It’s important to keep it simple.”

Many talks also mentioned the shift that identity is now making in the financial services space — as a standalone product rather than a compulsory service. During the talk “Commercializing through technology,” Kris De Ryck, CEO of BelgianMobileID, Gemalto CEO Philippe Vallée, and fintech influencer Bianca Lopes discussed the importance of trust, risk, and UX in an identity product or service offering.

Blockchain

As to be expected at a conference focused on fintech, the word “blockchain” was on the tip of many tongues. One panel dealing with the topic stood out in particular, as it involved participants from the following central banks: the Central Bank of England, Bank of Canada, Bank of Lithuania, and the Swiss National Bank. The topic of the panel was “Cryptocurrency, the central bank question.” Bank of Canada’s Senior Research Director in the Funds Management and Banking Department, James Chapman, had an interesting view on the possibility of integrating cryptocurrency into central banking systems–

“I don’t see that happening as long as central banks continue to do a good job of maintaining monetary policy. But could a cryptocurrency really spell the end of fiat currency? I think so. In a situation of hyperinflation where a central bank has abdicated responsibility for stability, then you could see a case for cryptocurrency.”

Another memorable discussion came from Ripple’s CEO, Brad Garlinghouse, who spoke to Simon Taylor from 11:FS on “Blockchain, digital assets and reimagining global payments.” As Ripple owns about 60% of the XRP token, he was discussing how Ripple aims to drive the use of XRP to foster the global financial ecosystem. He argued that selling and buying foreign exchange currencies with XRP would amount to a reduced time and cost rate. When asked whether there are already banks using XRP, Garlinghouse only named their existing payment provider partners, but did not elaborate whether banks already use it. During the interview with Simon, Garlinghouse also announced Ripple’s cooperation with 17 universities across the world (including the University of Pennsylvania and Wharton) to fund research on blockchain technology and the ecosystem as a whole.

Overall, the event was a great platform for both business and networking purposes. The keynotes and panels provided many learnings about the current state and direction of financial services, and there were plenty of opportunities to talk to key players and influencers in the industry. Until next year!