In the driver's seat: how embedded finance is re-shaping mobility pt. 2

5 minute read

When Karl Benz unveiled the Benz Patent-Motorwagen, the world's first retail car, in 1886, it was far from an overnight success.

In the years up to 1893, he sold just 25 units, despite the price — $150 (around $4,524 in 2021 money) — being relatively affordable compared to what cars sell for these days.

It took several refinements and improvements — and, crucially, his wife Bertha Benz driving 180km from Mannheim to Pforzheim to prove the car was safe — for sales to pick up. Even then, it wasn't until the early 1920s that private car ownership boomed.

Today, of course, it's a different story.

With 246.3 million cars on Europe's roads — 560 private cars per 1000 inhabitants — people who don't own a car are the rare exception.

Moreover, because of digital technologies, the modern car is increasingly smart and connected. And this means there are countless opportunities for OEMs — OEM stands for original equipment manufacturer, which in mobility means traditional car makers — to provide value-added services: from on-call breakdown assistance and insurance, to location-based travel and entertainment products and wider financial services.

Earlier in 2022, we partnered with the Handelsblatt Research Institute to explore consumers' willingness to use embedded finance products from brands in the mobility sector.

In the first of a two-part series, we discussed our findings in relation to airlines, train and bus operators, and other mobility providers.

In the second and last part, we'll explore when (and why) customers are open to using embedded finance products from OEMs. And, more importantly, what this could mean for the automotive industry moving forward.

The reliability advantage

So what would it take for consumers to take the plunge and buy embedded financial services products from their car brand?

As with mobility providers, our research suggests that, while being digital-first is an attractive proposition for some customers, innovation and willingness to try embedded financial services aren't correlated.

Rather, the key correlation is with trust. In other words, when customers perceive an OEM as being safe and reliable, they're usually more willing to try its embedded financial services.

In Spain, Germany, and Italy — three of the four markets we explored for our research — the perception of an OEM as safe and reliable had the highest correlation with willingness to try embedded finance products.

And while French customers told us they're most willing to use embedded finance products from OEMs they consider practical and family-oriented, safety and reliability came in a close second.

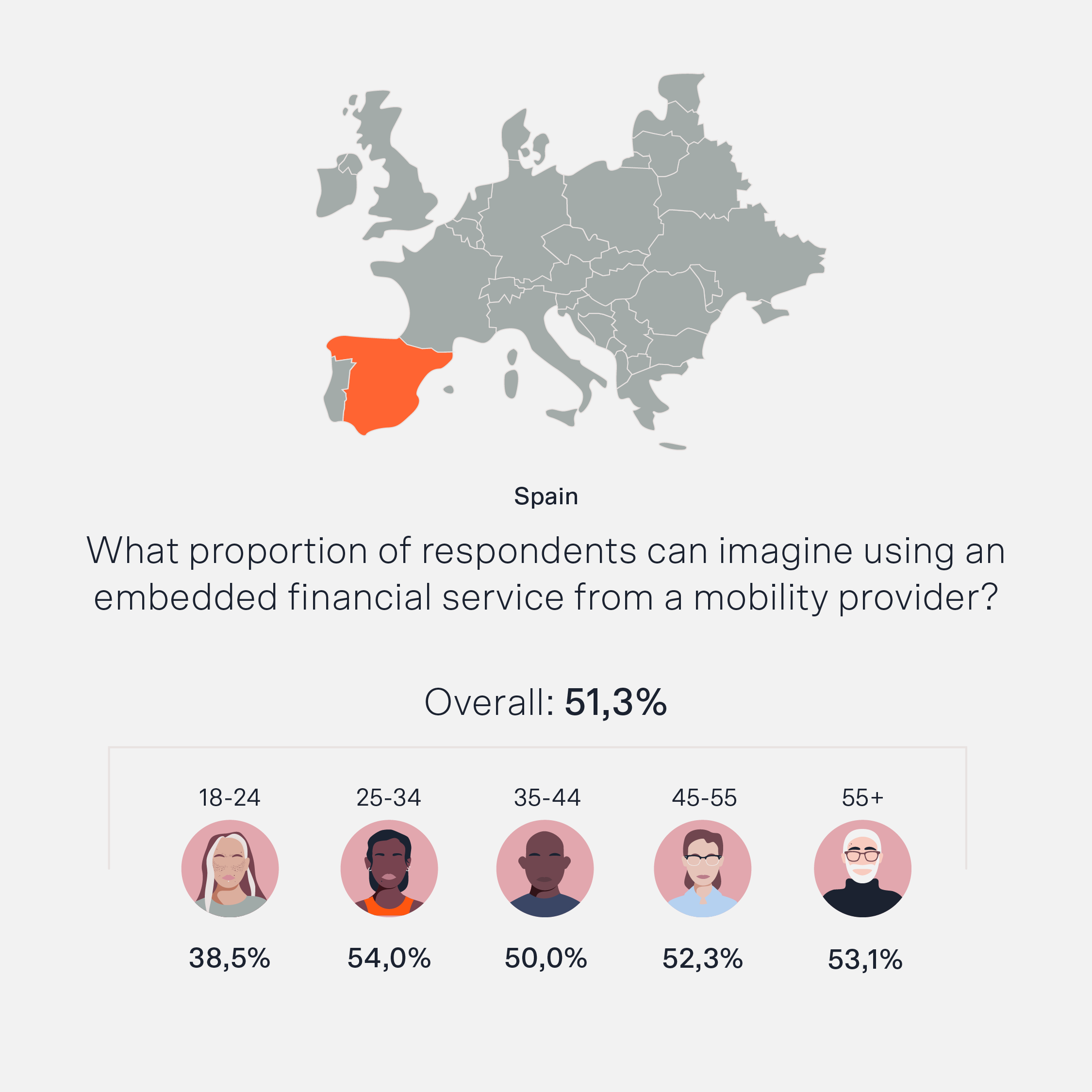

It's also worth noting that, while younger consumers are typically more likely to be early adopters, this isn't necessarily the case when it comes to embedded finance from OEMs. Our research found older consumers are as willing as younger ones to try car brands' embedded financial products.

In Spain, for instance, over 55s are the most willing consumer group: 53.1% are open to trying embedded financial services products from OEMs compared to 38.5% of 18 to 24-year olds.

And in France, 39.5 % of 45 to 54 year olds are open to trying embedded financial services products from OEMs, followed by 35.8% of over 55s and 31.6% of 35 to 44 year olds.

This finding is especially significant because car buyers are getting older. In Europe, the typical consumer looking to buy a new car is 53 years old. The upshot is that there's never been a better time for OEMs to launch embedded finance products.

A great step forward

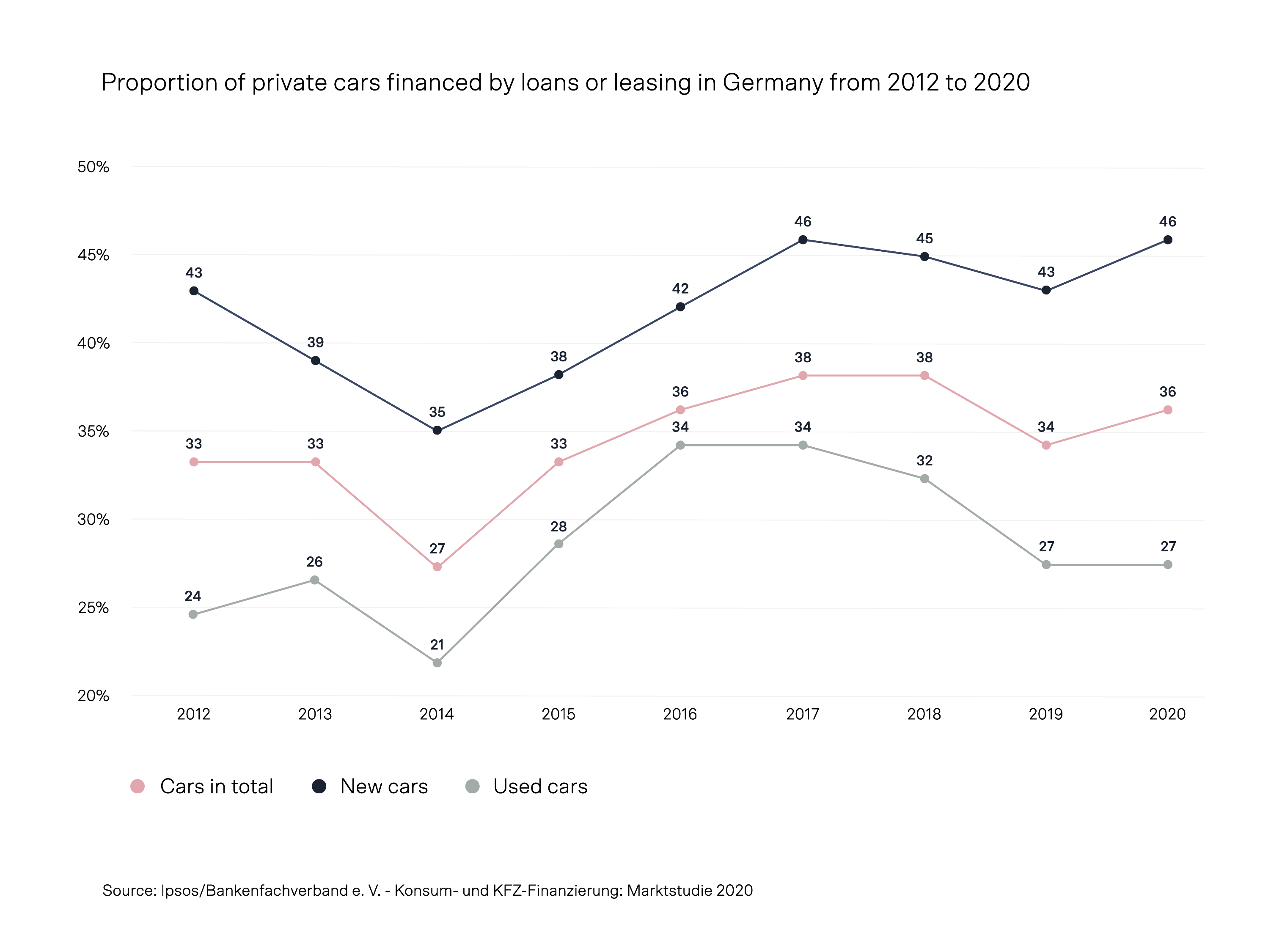

OEMs that offer financial services to their customers aren't a new concept.

German car giant Volkswagen, for instance, has its own bank and offers loans and complementary products like car insurance in more than 45 countries.

The same goes for other big names like Alfa Romeo, SEAT, and Renault. These brands also have financial services arms through which they offer products like leases and hire-purchase agreements.

What makes embedded finance different is that it takes things a step further, enabling OEMs to build much deeper relationships with customers.

Instead of serving a single purpose — financing a car purchase and, perhaps, insuring it — after which the relationship ends, embedded finance makes it possible for OEMs to become their customers' primary bank and, so, be part of their financial lives on an ongoing basis.

That means a greater number of customer touchpoints, more revenue, and higher lifetime value.

Porsche's branded credit card, for instance, gives holders valuable travel-related perks like priority city and airport parking, travel upgrades, and membership in car hire company Avis' Preferred loyalty program.

The brand earns revenue through the sizable annual membership fee it charges, interest on outstanding balances, and a slice of the interchange fees.

But, perhaps most valuably, every time the holder uses the card, it reinforces the emotional connection between them and the brand.

In particular, because Porsche is a luxury brand, the card is, in a way, a status symbol. Pulling the card out of their wallet is an opportunity for the holder to impress a family member, friend, or business associate.

Similarly, Tesla — another brand with strong emotional appeal — offers insurance products designed specifically for Tesla drivers.

The company earns more revenue through insurance premiums. And because its proprietary consumer data and insight into the technology that powers its products enable it to evaluate risk very effectively, its premiums are up to 30% lower than those of traditional insurers, which means drivers get a better deal.

But the embedded finance opportunity is even broader than this.

Alongside insurance, Tesla offers other subscription-based services such as music streaming and video on demand. There's scope for OEMs to extend the subscription-based model by offering broader travel-related financial services such as money exchange, travel spending analytics, or even entertainment services like hotel, restaurant, and event bookings.

In fact, with more and more people actively trying to change their behavior to protect the climate, OEMs could go much further and offer financial services products that enable consumers to offset their emissions.

Sustainable banking app Tomorrow, which protects 1m² of rainforest for every 1€ customers spend, is an excellent example of how this could be approached.

Mobility is no longer just about getting from A to B

Today's cars are a far cry from Karl Benz's Patent-Motorwagen. For one, they're quieter, more reliable, and far more comfortable to be in.

They're also safer, more energy-efficient, and smarter.

But it's not just the technology powering our cars and the other vehicles we rely on to stay on the move that has changed. Our habits have changed too.

Aside from a brief pause during 2020, travel — for work, for pleasure, or simply to visit family — is no longer an exceptional event. It's a normal part of everyday life. As a result, so has the need for financial services that help us make our journeys safer, stay in control of our spending, and enjoy the experience.

Because the relationship between mobility providers and their users is built on trust — trust that they'll get us from A to B safely and in relative comfort — they're uniquely placed to take on an even more central role in consumers' lives.

Through embedded finance, they can offer customers a more rewarding and convenient travel experience, while reaping big benefits themselves.

From planes, trains, and buses, to private cars, bikes, and scooters the mobility sector is increasingly digital, connected, and interdependent.