The Viewpoint: How bank accounts became the gateway to greater customer loyalty

9 minute read

While, for much of their almost 4000-year existence, bank accounts were predominantly a luxury for the wealthiest in society, they're becoming indispensable for everyone.

In much of the Western world, it's ever more difficult — and, sometimes, impossible — to receive your salary, pay for essentials, or access financial services products like loans and mortgages without a bank account.

Increasingly, the bank account is also a financial empowerment tool, helping consumers of all ages learn good money habits, budget and save more effectively, and grow their wealth.

In this post, we'll take a brief look at how owning a bank account went from privilege to necessity, and explain why there's no time like the present for any brand — even non-financial brands — to consider launching its own bank account.

A convenient storage solution

Bank accounts started out as a simple solution to a relatively simple problem: how to keep bulky or large volumes of valuables safe.

Before the invention of money, people exchanged what they needed for one or more items of equal value — a practice called bartering. The problem was that grain, precious metals, and other commonly bartered items took up a lot of space and could be easily stolen.

As trade grew, the ancient Mesopotamians — the same people who invented accounting and payment cards — came up with the idea of storing these valuables somewhere they'd be easily accessible and, at the same time, secure. And they decided that temples were ideal for this, for three reasons:

-

They were conveniently located in the heart of their settlements.

-

They were heavily guarded.

-

Best of all, unlike most other people in these ancient communities, priests could read and write. So, aside from their location and top notch security, using temples also meant it was possible to keep accurate records.

Eventually, the ancient Romans started storing valuables in purpose-built buildings — the first banks.

By this time, money had replaced bartering as a simpler, safer, and more convenient form of payment. So, alongside deposits, Roman bankers developed other financial services products, including loans and mortgages.

The first "modern" bank accounts

While banking thrived throughout the Dark Ages, the bank account as we know it today only came to be during the Renaissance. And, like the temples of ancient Mesopotamia, these proto-accounts were all about convenience.

In the 14th and 15th centuries, city states like Pisa, Siena, and, most significantly, Florence, became important international trade hubs where large amounts of money would change hands every day.

This gave some merchants the idea of offering storage-as-a-service. In other words, traders could hand over their money for safekeeping, get a receipt as proof, and make withdrawals as and when they needed.

Over time, merchants started exchanging these receipts, which became known as promissory bills, in other trading centres across Europe.

As a result, the idea spread, and a network of banks catering to merchants, traders, and other businesspeople — these became known as merchant banks — was established.

The Berenberg Bank, Germany's oldest bank, was founded in 1590 by cloth merchants Hans and Paul Berenberg. Even Monte dei Paschi di Siena, which started as a pawnbroker in 1472 and is the oldest bank in the world, diversified into merchant banking. Interestingly, it was also one of the first banks to offer a depositor guarantee.

But while these first bank accounts worked in much the same way they do today, they were expensive and mainly aimed at businesses, so it only made sense to open one if you were wealthy.

It wouldn't be until 1810 that the first bank account designed specifically for regular people — issued by the Savings and Friendly Society — would emerge.

Banking for everyone

The Rev. Henry Duncan, a Scottish minister, was inspired to launch the Savings and Friendly Society as a way to help his parishioners lift themselves out of poverty and take control of their financial future.

Where regular banks had a minimum deposit requirement of £10 — a massive £620 (around 720€) in 2022 money — you could open an account with the Savings and Friendly Society with just sixpence (around £1.22, or 1.42€, in 2022 money). Depositors also received 4% interest on every pound, and any surplus went into a charity fund to help those in most need.

Over the next century, the idea that anyone would benefit from a bank account spread around the world. Eventually, even mainstream banks came round, mainly because they needed more depositors so they could meet the huge demand for credit created by the post-WWII economic boom.

By the 1950s, it was commonplace to offer rewards — including flashy gifts like toasters and clock radios — to entice new customers into opening accounts. This practice remains popular today, with banks offering cashback, airline miles, and all sorts of other perks to bring in more business.

Location-independence

At the same time as bank accounts were gaining mass-appeal, they also started becoming more accessible.

In a world where we can whip out our smartphone any time, anywhere, and carry out transactions electronically, ATMs may seem clunky and outdated. But when they were launched in the 1960s, they were revolutionary.

For the first time ever, customers weren't tied to their bank's location and opening hours. They could deposit or withdraw money and do basic tasks like check their balance at their convenience.

The invention of the magstripe and, subsequently, chip-and-pin and contactless technologies took things even further, making it possible to pay cashlessly and, so, not even have to make the trip to the ATM.

But it would be the computer and the internet that would fundamentally reshape the bank account — and banking itself — once and for all.

The digital big bang

Banking first went online in 1982, when the UK-based Nottingham Building Society launched HomeLink, a system that enabled customers to access their bank account using their computer, landline, and TV.

The system was groundbreaking, but also way ahead of its time. Slow and extremely expensive, it had to be shut down less than two years later.

Of course, once computers became cheap, the internet went public, and more households got connected, it was a different story. One by one — starting with Wells Fargo — banks began launching online portals.

By the late 2000s, online banking had become an arms race.

Digital technology had advanced to a degree where we now carried internet-enabled supercomputers in our pockets.

More to the point, customers' attitudes had shifted. We'd become used to the speed, convenience, and seamless customer experiences of tech giants like Apple, Google, and Amazon, and expected the same from banks.

As a result, a new breed of bank — the digital-first neobank — emerged and started capitalizing on this desire for a smoother, more intuitive, and personal banking experience.

Unlike traditional banks, these challengers had no physical branches.

More significantly, they charged lower, more transparent fees, had easy-to-use, feature-rich apps, and you could open an account in hours, while traditional banks could take weeks.

The unbundling of banks

It's no understatement to say that neobanks have reshaped banking as we know it.

The first wave of neobanks — Monzo, Revolut, and N26 just to name three — made being digital-first their competitive differentiator. But, over time, more sophisticated challengers emerged, with a focus on serving specific niches.

Clanq, for instance, is designed specifically for families.

Parents can create sub-accounts for their children, so they can give them financial independence while staying in control of their spending. There are also features aimed at making saving easy — and fun.

Christina Hammer, CMO & co-founder of Clanq, explains why a family account with savings options is so attractive:

The whole family can contribute to saving for the children's financial future, saving becomes a routine for everyone. Clanq combines the savings process with cashback on every purchase, saving rules and sustainable investments for better performance.

By contrast, alongside basic bank account and money management features, a financial "super-app" can offer users investment digital assets like stocks, shares, and even cryptocurrencies.

Aside from growing specialization, the technological landscape has also shifted.

The gap between neobanks and incumbents' digital offerings has narrowed considerably. Some legacy banks, like Goldman Sachs, have even launched their own wildly successful digital-only offshoots.

But the biggest developments to date have undoubtedly been banking-as-a-service and embedded finance technology.

The former has significantly lowered the barriers to entry. Secure, regulated banks have productized their license, compliance, treasury, and other back-end infrastructure, making it possible for businesses to concentrate on what they do best — technology — without having to pivot part of their operations to financial services.

Embedded banking technology, on the other hand, has made banking accessible once and for all to non-financial players as an additional service to customers.

Customers can now get specialized bank accounts and other tailor-made financial services at the point of need, without having to leave their favorite app. The BaaS provider handles the complexities being a financial services company entails, while the business develops the product, using the data it already has on its customers to make it as personal and relevant as possible.

The embedded banking opportunity

The unbundling of bank accounts and other financial services couldn't have come at a better time for non-financial brands.

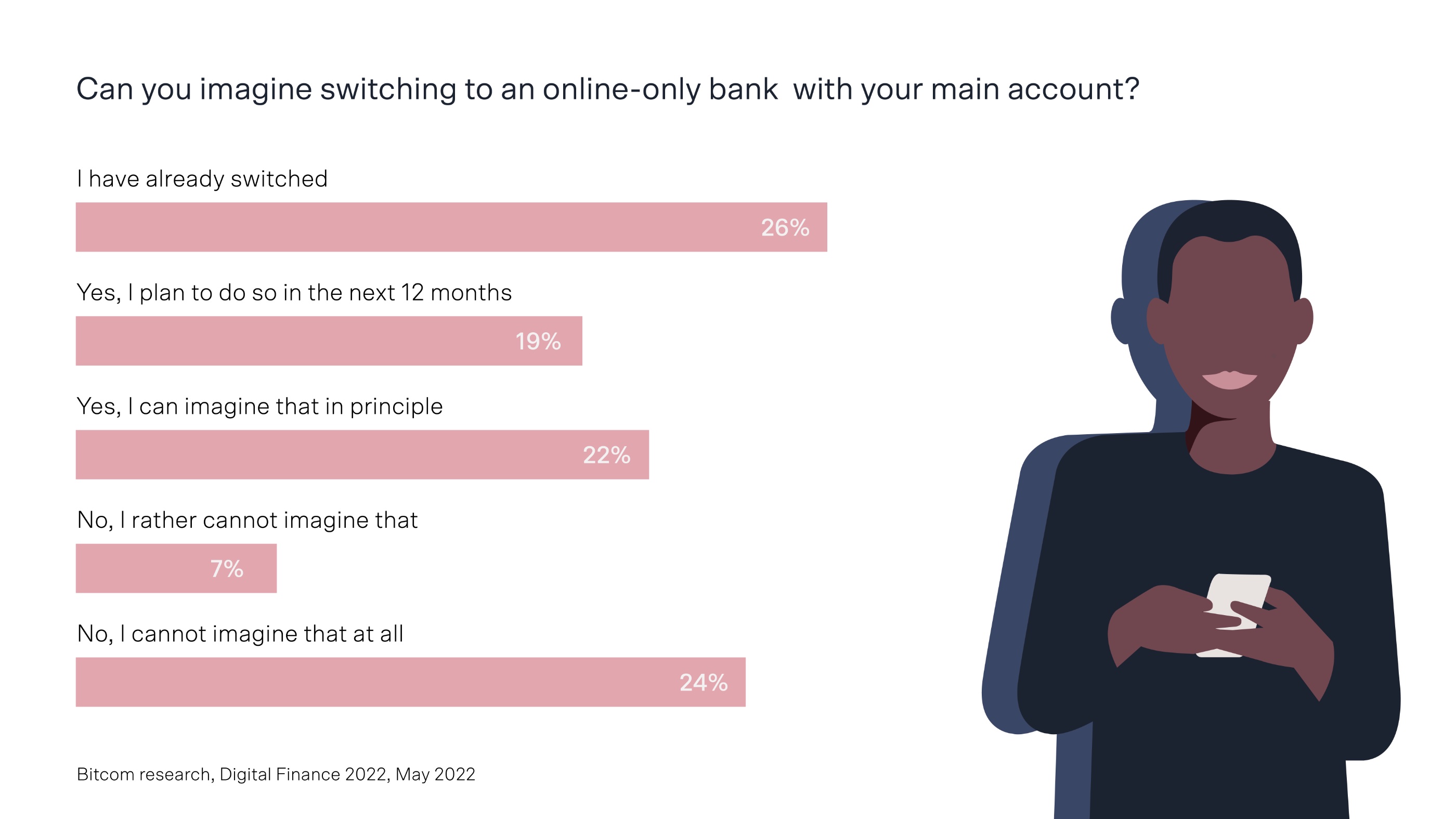

For starters, consumers have never been more open to change. While 84% of Germans say they're satisfied with their bank, 77% can see themselves switching if a better offer comes along.

And, according to our own research, 61% of German consumers would buy financial services from ecommerce stores, while over a third of consumers in Germany, France, Italy, and Spain would open a bank account with a mobility provider.

Crucially, following the Covid-19 pandemic, 44% of Germans plan to keep paying for their purchases using cards and other cashless methods. Methods that usually require access to a bank account. And this means bank accounts will likely become more and more important over the coming years.

For non-financial brands, this is a golden opportunity for three reasons:

1. Deeper customer relationships

Once a customer opens a bank account with the brand, the relationship stops being purely transactional.

The brand, through the bank account, has a much more important role in the customer's life: it has become an essential service. The customer also interacts with the brand more frequently — when they log on to check their balance, pay their bills, or, more simply, when they take out the branded debit card linked to the account to pay for everyday essentials or purchases at other stores.

Every touchpoint strengthens the relationship, reinforcing the connection between the customer and the brand.

2. New sources of revenue

In a world where competition is getting stiffer and margins are shrinking — particularly in the current economic climate — embedded financial services are a way for brands to diversify their income.

A bank account is a relatively low-stakes product. A foot in the door, if you will. But once the customer has opened an account, the brand is in a position where it can offer more valuable financial services products such as credit cards and loans.

Significantly, brands can use the data they have on their customers to make the product more relevant and present it to the customer at the right time, increasing the likelihood of uptake.

3. Greater loyalty

Alongside boosting revenue, adding financial services products on top of the bank account also has another benefit: it increases customer loyalty and lifetime value.

Brands can also strengthen their offering through features such as loyalty points, cashback, and other exclusive rewards that encourage customers to use the bank account — and the brand's other financial products — more frequently.

Clanq, for instance, offers up to 25% cash back on purchases.

Similarly, Uber drivers who use the ride-sharing app's branded bank account can earn 1% cashback or get a discount at participating merchants.

Looking ahead: what's in store for the bank account in the coming years?

From its humble beginnings as a secure storehouse, bank accounts have evolved into the hubs of our financial lives. Alongside the basics — paying and getting paid — they've become tools that help us budget, save money, grow our wealth, and even teach good financial habits to our kids.

While it's hard to predict exactly how bank accounts will evolve over the next few years, chances are they'll become smarter and more specialized.

We asked Benjamin Esser, CEO of Kontist, where he sees the future of the business account.

The business bank account of the future will be a one-stop-shop for business owners, integrating various financial tools such as accounting software, invoicing and lending platforms, making it more convenient for them to manage their finances. In addition, advanced security measures like biometric authentication and two-factor authorization will become more important as the risks of fraud and hacking increase.

Machine learning and other advanced technologies will make it possible for our account to learn our habits inside out and give us better advice and more control. And decentralized finance apps will democratize the industry, enabling people to buy financial services products they might not be able to access through traditional channels.

Most of all, it will be possible for consumers to bank without banks. And, by launching their own highly targeted bank accounts and other financial products, non-financial brands can position themselves as the ideal choice for their customers and add more value to their offering.

Want to deepen your relationship with your customers and strengthen your brand while creating a valuable new revenue stream?

Learn more about our powerful, easy to use banking-as-a-service API.