Know-Your-Customer Platform

Onboard customers smoothly with full AML-compliant KYC check

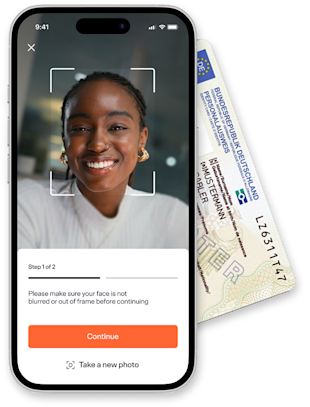

Streamline digital onboarding with Solaris’ Know-Your-Customer platform. Pick the verification methods you need — like ID scan, biometrics, or active liveness checks — and tailor flows to your customer types.

Ensure compliance with EU AML directives while onboarding consumers, freelancers, legal entities, and UBOs — all through a single platform.

All-in-One KYC platform for scalable, compliant growth

Flexible verification options

Offer one or multiple identity verification methods — digital or in-person — depending on your risk model and customer journey. Let users choose the most convenient option while you stay in control of compliance.

One platform for all customer types

Verify consumers, freelancers, legal representatives, and beneficial owners (UBOs) — all through a single, unified API.

Scalable API infrastructure

Integrate via RESTful APIs to access Solaris’ in-house verification methods and vetted third-party providers — without the integration overhead. Scale confidently as your business needs evolve.

Fully digital onboarding, no paperwork

Automate onboarding with paper-free, mobile-first flows. Deliver fast, secure experiences — with identity checks completed in minutes, not days.

Trusted, compliant partner

Solaris is a licensed German bank. Our KYC solution meets EU AML regulations and supports local compliance obligations, giving you a reliable infrastructure partner — not just a vendor.

Advanced KYC add-ons — built for evolving compliance

Strengthen your onboarding flows with verified add-ons designed for evolving AML obligations. Add capabilities like qualified electronic signatures (QES), address validation, device monitoring, and real-time mobile and PEP/sanctions screening — all integrated into the Solaris platform.

Each tool is built to help you manage fraud risk, reduce manual reviews, and stay audit-ready.

Videoident

Use Videoident to meet enhanced due diligence (EDD) requirements in high-risk scenarios. Trained agents verify ID documents and liveness via secure live or recorded video calls.

Powered by Solaris and IDnow, this method ensures full German AML compliance — ideal for lending, credit, and other regulated use cases.

eID

Enable fully compliant digital onboarding for low- to medium-risk customers using Germany’s electronic ID (eID). Customers scan their ID card with a smartphone, enter a PIN, and complete encrypted identity verification — all in minutes.

Backed by Solaris and IDnow, this method ensures full compliance with AML requirements.

Fotoident

Fotoident captures ID photos, runs biometric and movement checks, and routes cases for expert review when needed — enabling digital onboarding and periodic customer re-identification in Italy, France, and other supported markets.

Powered by Solaris, Fourthline, and IDnow, Fotoident meets AML requirements outside Germany and supports QES where local regulations require it.

Other KYC options to fit every onboarding need

Provide flexible identity verification methods tailored to your customers’ preferences and risk profiles.

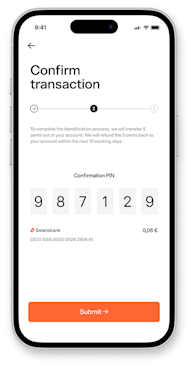

Bankident enables instant customer identification via a secure penny-drop bank transfer, accelerating low-friction onboarding.

For in-person verification, PostIdent lets customers identify themselves at any Deutsche Post branch — fully AML compliant, ideal for low-risk cases.

Hear what our partners have to say

Standalone or integrated KYC solutions to fit your growth

Standalone KYC

Address your onboarding needs quickly with Solaris as a trusted partner. Launch identity verification independently and scale into embedded finance as your business grows.

KYC with integrated financial products

Extend beyond KYC by embedding financial products like bank accounts, cards, or overdrafts. Solaris offers flexible, modular solutions tailored to your use case and growth plans.