Know-Your-Business Platform

Verify your business customers in 48 hours

Digitally verify new business partners in just 48 hours with our KYB solution. Cut onboarding time, reduce manual checks, and meet European AML, KYC, and local requirements.

Backed by a licensed banking partner, the platform delivers secure, scalable business identity verification – so you can accelerate time-to-revenue.

Onboard verified businesses faster – no added risk

Digitize your KYB process

Eliminate paperwork with a fully digital, scalable KYB solution designed for fast, compliant business identity verification.

Verify businesses in 48 hours

Cut onboarding time from weeks to 48 hours with automated KYB checks – built to support compliance.

Integrate white-label KYB

Embed our white-label KYB directly into your user interface for a seamless onboarding experience that builds trust and reduces drop-off.

International business onboarding

Verify companies across borders with a KYB platform engineered for international coverage, operational efficiency, and regulatory alignment.

Ensure AML, KYC & regulatory compliance

Maintain compliance with AML, KYC, and evolving local regulations – using state-of-the-art KYB technology.

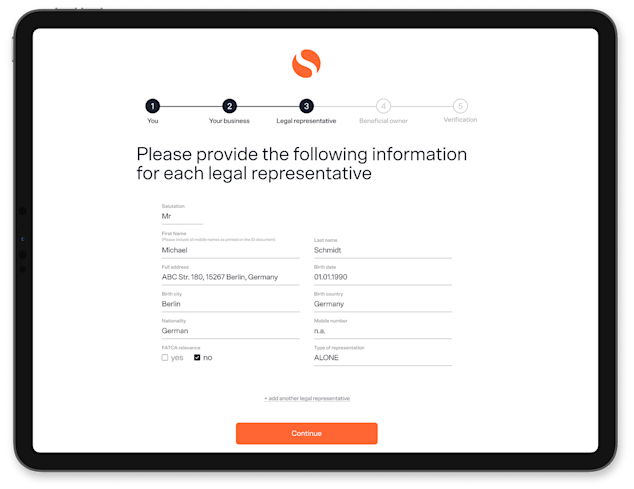

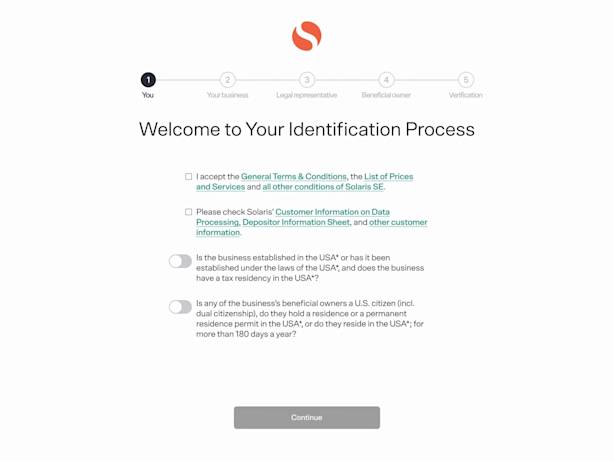

Business verification in 5 simple steps

- 1

Submit business and contact details

Your customer provides their role, company information, and verification request context.

- 2

Identify legal representatives

The new partner lists all individuals authorized to make decisions on behalf of the company.

- 3

Confirm & verify representatives

Our platform verifies the identity and decision-making authority of the listed representatives.

- 4

Declare Ultimate Beneficial Owners

Customers disclose individuals (UBOs) who ultimately own or control the business.

- 5

Complete KYB with business information

Final details – such as business structure, industry, and ownership – are submitted to finish verification. Solaris’ KYB experts will verify information carefully to ensure compliance and security.

Combine KYC and KYB to meet compliance with less friction

Easily verify both legal representatives and UBOs using our flexible KYC-KYB integration.

Configure the right level of checks based on your compliance requirements and customer risk tiers.

Offer a seamless, secure onboarding experience that balances regulatory obligations with user convenience – without compromising speed or security.

Hear what our partners have to say

�“Through our partnership with Solaris, we combine state-of-the-art embedded finance technology with innovative product solutions in the SpenditCard. This allows us to create a seamless and forward-looking customer experience that sets new standards in terms of user-friendliness, reliability and personalization for our customers.”

CPTO, Spendit

Start with KYB, scale into embedded finance

KYB as a single product

Solve business onboarding from day one with our KYB platform. Launch fast, verify business customers efficiently, and stay compliant. Expand into embedded finance – add accounts, cards or payments – when your roadmap demands it.

KYB with integrated financial products

Combine KYB with Solaris accounts, cards, and payments to deliver a unified onboarding and product experience.

Access a comprehensive financial ecosystem that unlocks higher customer lifetime value – all within a single platform.