HR Tech

Unlock growth: seamless financial solutions for HR tech

Cloud-based HR tech providers and comprehensive HR platforms targeting SME clients face increasing demands to optimize perks budgets and automate payroll processes.

By embedding Solaris’ financial services such as digital prepaid cards for expenses or benefits and integrating payroll through dedicated accounts, HR techs can significantly enhance customer retention and unlock new revenue streams.

Revolutionize employee budgeting and payroll automation

SMEs strive to incentivize their teams while ensuring budget transparency and avoiding fraud.

By embedding prepaid perks cards and automated payroll solutions, HR tech platforms simplify expense tracking, enhance financial planning transparency, and streamline batch payroll payments.

Enhance your HR tech with embedded finance

Partnering with Solaris empowers HR tech companies to integrate robust financial offerings, including a compliant Know-Your-Business (KYB) onboarding process.

Solaris, a fully licensed German bank, ensures rapid deployment of digital-first SME bank accounts within 48 hours, advanced employee benefit solutions for market differentiation, the possibility to use all financial features for a centralized interface for perks, payroll, expenses, and tax reconciliation – integrated by our partners.

Fuel your HR platform

Increased customer loyalty

Enhance customer stickiness by simplifying their financial processes. Clients regularly interact with your brand through embedded financial tools.

Revenue diversification

Tap into new revenue streams by offering digital banking products, prepaid debit or credit cards for employee perks – strengthening your competitive edge.

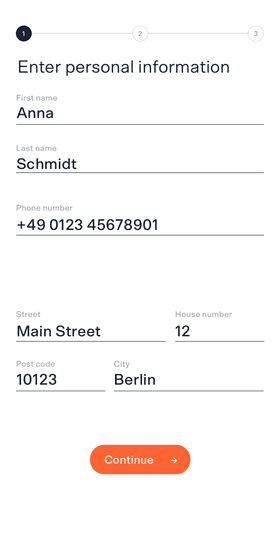

Scalable onboarding

Leverage customer-friendly KYB methods and digital onboarding to deliver outstanding SME customer experiences efficiently.

Safe and compliant

As a licensed bank Solaris provides deposit security under EU regulations, insured up to €100,000 per customer.

HR success stories

How the SpenditCard embeds financial features into HR platforms

The SpenditCard serves as a powerful example of how financial services can be natively embedded into a benefit platform.

The SependitCard is a Visa prepaid card providing a non-cash benefit, called benefit-in-kind (BIK), to the holders. Employees receive tax-friendly and flexible benefits, including the €50 tax-free benefit, recreation allowances, and internet subsidies.

The solution significantly enhances operational efficiency by streamlining the administration of employee benefits. It also simplifies payroll processes and reduces the overall administrative burden for employers when granting such perks.

Hear what our partners have to say

“Solaris meets our high standards in terms of quality and innovation and offers us and our SpenditCard customers maximum security and reliability.”

CEO, Spendit

Own payroll & payments: the HR tech finance playbook

HR tech is scaling fast. Our new guide shows how embedded finance – B2B accounts, expense cards, and KYB – automates payroll, reimbursements and reconciliation, delivers cash-flow insights, and boosts retention.

Learn through data-driven use cases how to build a compliant HR finance hub for SMEs and capture a 20–30% EBITDA uplift.

Unlock next-level efficiency with great financial features

Business bank accounts

Integrate business bank accounts into your HR platform to streamline financial management, expenses, payroll, and supplier payments effortlessly.

Payment cards for expenses or benefits

Enhance your HR tech solution with our versatile prepaid and debit cards, simplifying expense management and enabling flexible, tax-optimized employee perks.

Embedded KYB

Seamlessly embed Solaris’ KYB solution to streamline client onboarding, mitigate fraud risks, and ensure regulatory compliance, enhancing security and customer experience.