International Bank Account Number (IBAN)

79% of adults worldwide — well over 5 billion people — have at least one bank account. So how do payment rails route funds to the right one every time?

In Europe — and in a growing number of other regions — they do this by checking the account's IBAN.

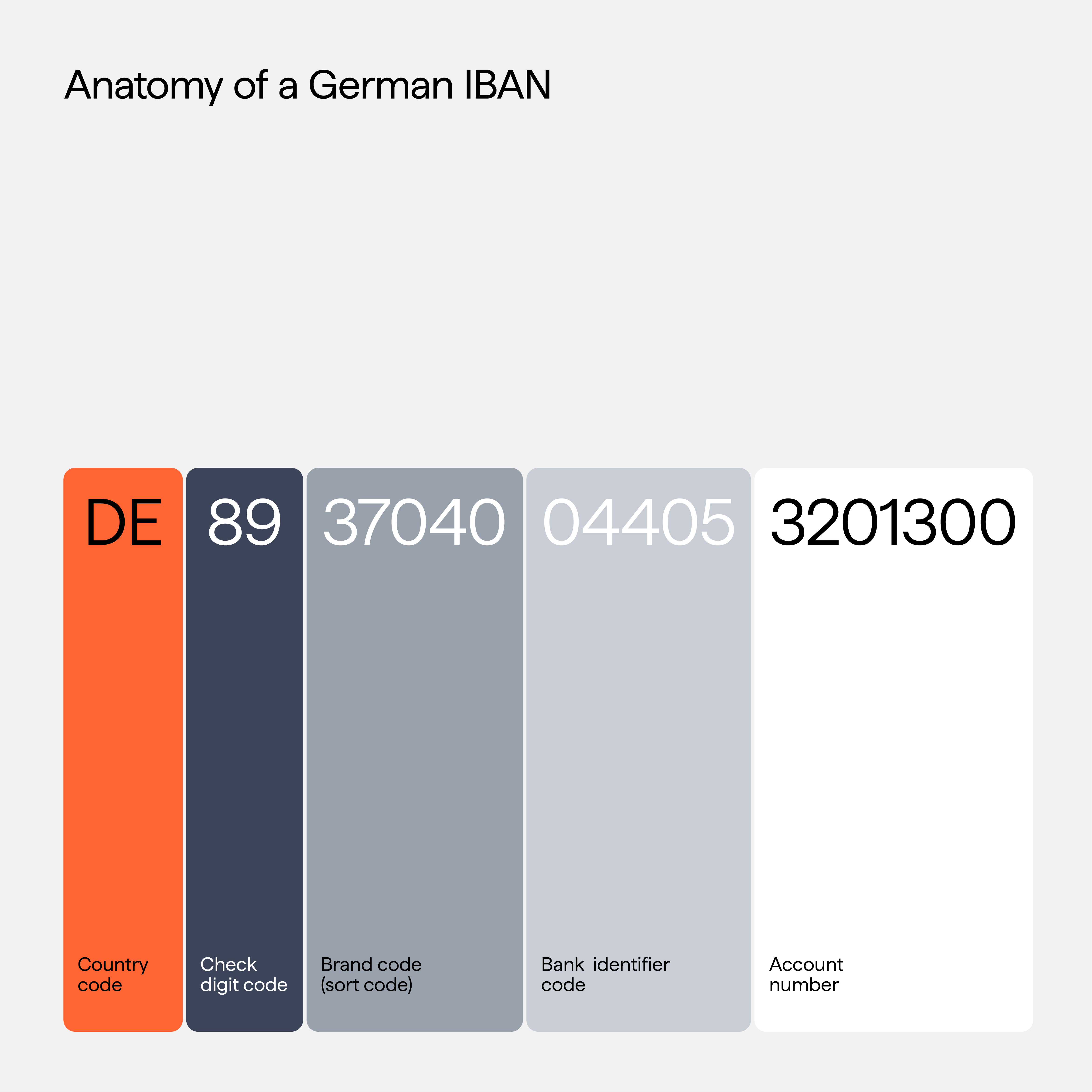

Short for International Bank Account Number, an IBAN is the banking equivalent of a street address. It can be up to 34 alphanumeric characters long, and is made up of four components:

A country code

These are the two letters assigned to the country where the account is located by the ISO 3166-1 alpha-2 standard — DE for Germany, FR for France, GB for the UK, IT for Italy, and so forth.

Two check digits

The first two numbers after the country code. Payment rails use check digits to verify that an IBAN is correct. The system runs a standardized mathematical calculation called Modulo 97. If the answer matches the check digits, the IBAN is likely valid.

The recipient's bank account number

Also known as the BBAN — Basic Bank Account Number — this is an individual bank account's unique identifying number. Alongside the account number, this section also includes numerical bank and branch identifiers. The structure and length of BBANs (and bank and branch identifiers) is set by national banking authorities and is unique to every country.

National check digits

Some countries also include extra numbers within their IBANs, usually in the BBAN. These work as an extra layer of error detection, ensuring the IBAN has been typed correctly in accordance with local banking rules. Countries that use national check digits include France, Italy, and Spain.

Interesting facts

- The European Committee for Banking Standards proposed IBANs in the mid-1990s. At the time, there was no standardized way to identify bank accounts in Europe, which made cross-border payments challenging and fraught.

ISO 13616 standardized IBANs' structure and technical format in 1997, and SWIFT now maintains the IBAN registry on ISO's behalf.

-

While IBANs were initially intended for Europe, adoption has expanded beyond the continent. As of 2024, 88 countries use IBANs, including several in Africa, Central and South America, and the Middle East.

High-profile economies that don't use IBANs include the United States, Canada, Australia, and the Asia Pacific region. However, these countries must still deal with IBANs in case of international transactions involving countries that use them.

-

Despite having a standardized structure and format, IBANs can still vary dramatically in length from one country to another. Norway has the shortest IBANs — 15 characters long. Denmark, Finland, and the Netherlands have slightly longer, but still relatively short IBANs — 18 characters long.

Most European countries' IBANs are between 20 and 28 characters long. No country uses the maximum of 34 characters (though some use 33).

Further reading

- SWIFT's IBAN resource center is the definitive resource for all things IBAN-related. It covers standards, up-to-date formats for every country that uses the system, as well as technical documentation.

- Alongside the recipient's IBAN, international transfers also require a SWIFT code. Short for Society for Worldwide Interbank Financial Telecommunication, SWIFT codes are between 8 and 11 characters long and identify a specific bank. They consist of a bank code, country code, location code, and, optionally, a branch code. This glossary entry explains SWIFT in detail, how they differ from IBANs, and how IBANs and SWIFT codes work together.