Bank Recovery and Resolution Directive (BRRD)

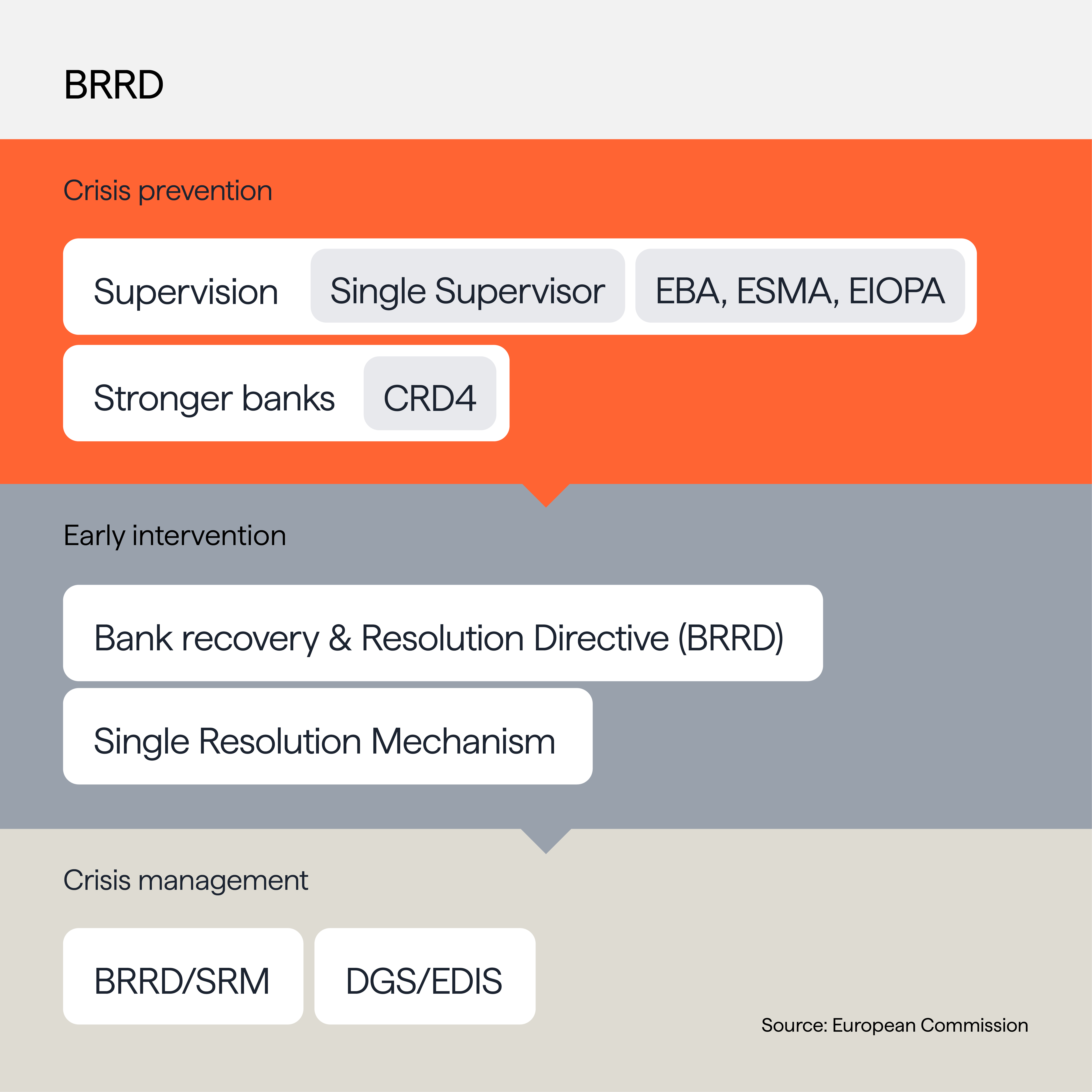

The Bank Recovery and Resolution Directive (BRRD) is the European Union’s framework for handling failing banks while safeguarding financial stability and minimizing the burden on taxpayers. Introduced after the 2008 financial crisis, its goal is to ensure that banks can be resolved in an orderly way without resorting to public bailouts.

Key elements of BRRD

- Recovery and resolution plans: Banks must prepare recovery plans that outline how they would restore viability in times of severe stress. Resolution authorities develop resolution plans that set out strategies if recovery is no longer possible.

- Bail-in tool: Instead of relying on public money, shareholders and creditors absorb losses first. This shifts the cost of failure away from taxpayers.

- Resolution authorities: Each EU Member State designates national resolution authorities, working closely with the Single Resolution Board (SRB) for euro area banks.

- Minimum requirements for own funds and eligible liabilities (MREL): Banks must maintain sufficient loss-absorbing capacity to support resolution measures.

Oversight and enforcement

The Single Resolution Mechanism (SRM), led by the SRB, coordinates resolution actions across the euro area. National resolution authorities are responsible for banks in their jurisdiction, ensuring BRRD rules are properly applied. The European Banking Authority (EBA) also issues technical standards and guidelines to harmonize practices across the EU.

Why BRRD matters

The BRRD strengthens trust in the European banking system by showing that failures can be managed without destabilizing markets. It protects depositors, ensures continuity of critical banking functions, and reinforces market discipline by making investors and creditors bear the risks of bank failure.