Bank Identifier Code (BIC)

As an end-user, transferring money is usually a simple matter of entering the amount and recipient's details, then pressing send. But a lot goes on behind the scenes before the money reaches its destination.

Key among them, your bank must communicate securely with the recipient bank. And, if the two banks aren't located in the same country, or don't have a direct relationship for other reasons, intermediary banks have to get involved to facilitate the transaction.

So how do all the parties — sending bank, recipient bank, and any intermediaries — keep track of who's who?

That's where the BIC — short for Bank Identifier Code — comes in.

BICs are a sequence of eight or eleven alphanumeric characters.

Each BIC is unique to a specific bank. Think of it as a bank's phone number, or email address. It enables sending banks, recipient banks, and any intermediaries to make sure they're communicating with the right counterparty, and that your money ends up where it's supposed to.

The terms BIC and SWIFT code are used interchangeably, but there's a slight technical difference. All SWIFT codes are BICs, and both BICs and SWIFT codes are issued and managed by SWIFT — the Society for Worldwide Interbank Financial Telecommunication.

However, some BICs are known as non-connected BICs. This means they don't have access to the SWIFT network, and banks use them only internally for reference purposes.

From a practical perspective, this is neither here nor there. Since they can't be used to process payments, non-connected BICs aren't publicly available. All BICs banking customers have access to are also SWIFT codes.

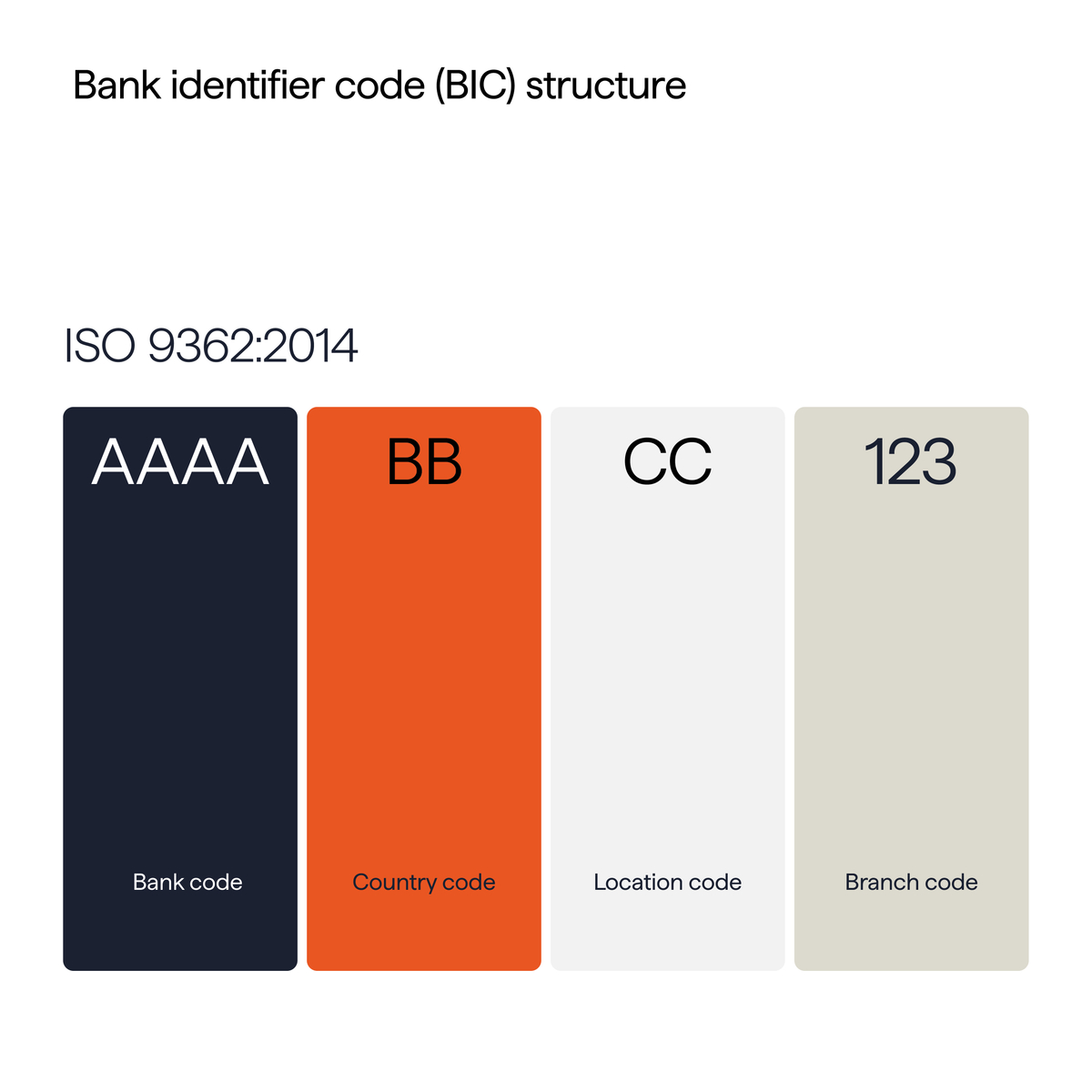

Because of their near-identical similarity, BICs and SWIFT codes follow the same format:

- A four-letter bank code that represents the name of the bank

- The ISO 3166-1 alpha-2 standard two-letter country code. For example, DE for Germany and IT for Italy

- A two-character location code that represents the bank's HQ or main office. It can consist of letters, numbers, or a mix of both

- An optional three-character branch code, pinpointing the specific branch. Sometimes this will be XXX — a default code that points to the bank's main office

Interesting facts

-

What came first? BICs or SWIFT codes?

It's… complicated. SWIFT, which was set up in 1973, defined the term BIC first, with SWIFT as the registration authority. BICs subsequently started being referred to as SWIFT-BIC and, eventually, SWIFT code or SWIFT ID.

SWIFT officially codified BICs' structure around 1975. They're now part of the ISO 9362 standard, which today also includes business identifier codes used by non-financial institutions.

-

Alongside transaction processing, banks also use BICs to communicate with other banks via secure messages. In 2024, banks sent each other over 50 million messages a day through SWIFT.

-

In most international transfers, you'll need the recipient's BIC, or SWIFT code, and their account number or IBAN. But, if you're transferring money to the US or Canada, you'll also need a routing number — also known as ABA, ACH, or transit number.

Routing numbers are unique nine-digit codes used domestically to identify a specific bank.

Further reading

- If you're interested in the technicalities of international transfers, this article includes a deep dive into the mechanics of the process, including message types, encryption, and the fee structure.

- SWIFT's BIC policy document sets out how organizations can and can't use connected and non-connected BICs.