How AI will change banking forever - Part 2

5 minute read

genAI is rapidly transforming the banking industry – reshaping customer service, streamlining operations, and promising smarter interactions with customers.

But as with any powerful new tool, there are bound to be a few surprises.

A German digital bank, for example, rolled out a new genAI-powered chatbot. All seemed well, until two savvy finance journalists decided to ask it more than just the usual "What's my balance?" kind of questions. Instead, they probed deeper and the chatbot answered. Very specifically. In German. About upcoming, not-yet-public features.

Anecdotes aside, genAI represents the future of banking, even if a chatbot occasionally reveals too much.

According to EY's 2024 European Financial Services AI survey, 72% of executives plan to significantly increase genAI investments in 2025, with 69% expecting substantial productivity gains.

Two clear trends underline genAI's growing role in financial services: First, more professional tasks are being delegated to AI agents. Second, these AI agents are rapidly advancing, becoming increasingly capable of interacting seamlessly with real-world systems through APIs and digital interfaces.

Together, these trends reinforce each other, creating a new economically significant demographic – AI agents – and signaling the rise of what can be termed "agentic economy."

This shift will trigger a substantial productivity boost within the financial sector, reshaping the industry landscape.

For example, European banks have historically struggled to improve productivity, but genAI offers a compelling solution. According to NTT Data research, productivity is the highest priority (46%) for banks implementing genAI, highlighting a strong emphasis on return on investment (ROI).

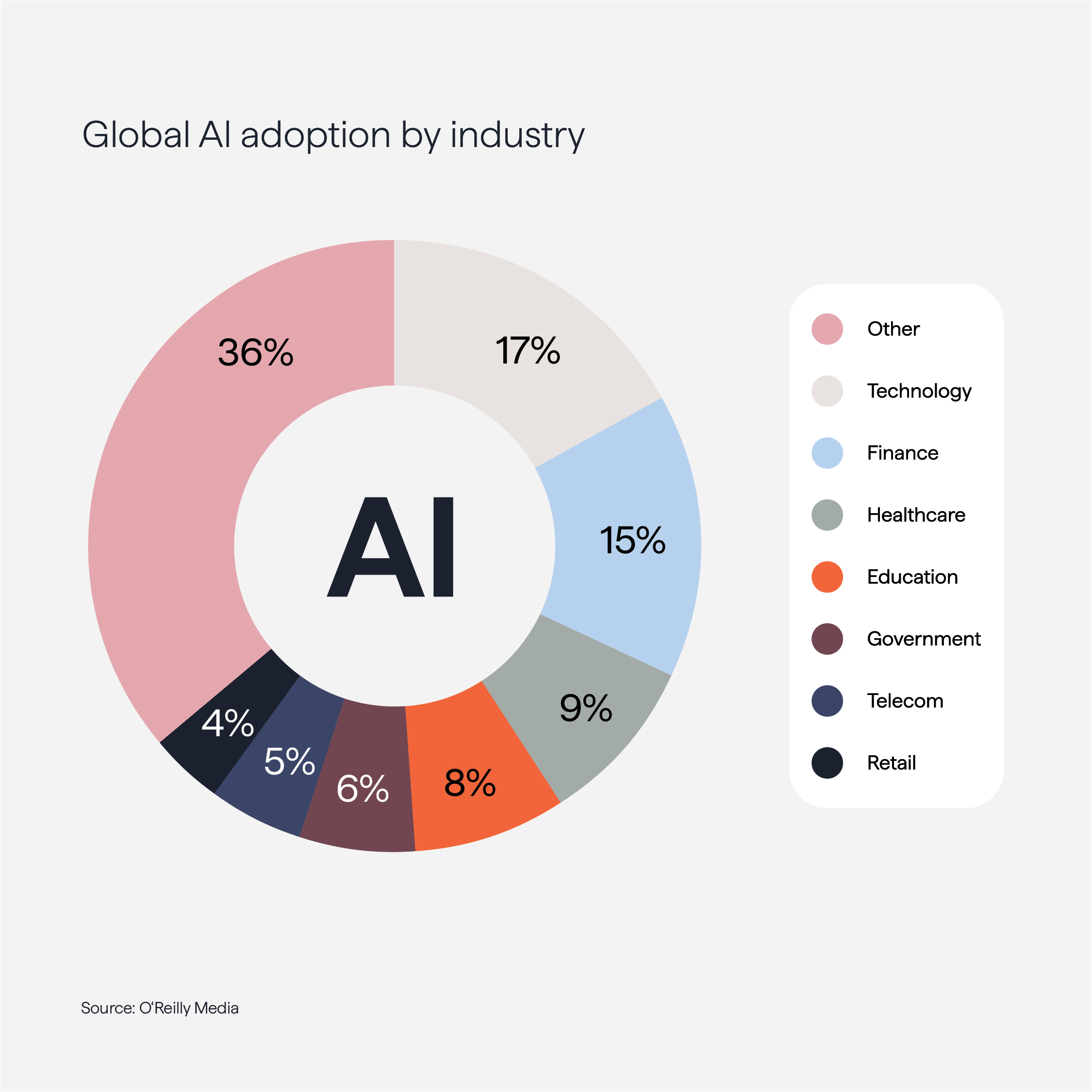

It might be one of the reasons why the financial industry is already a leader in AI adoption, only topped – logical – by the technology sector.

And 15% of all players in the financial industry are working with AI in daily business operations.

Vladimir Grigorev, Lead, Commercial Data Projects at Solaris, points out:

“Banking has always been one of the most data-intensive industries, and classic AI has naturally been implemented across fraud detection and credit scoring capabilities. Now, the genAI wave is fundamentally changing parts of the business where unstructured data sits – customer support, operations, legal and compliance.”

genAI use cases from financial industry heavyweights

Leading financial institutions are increasingly leveraging genAI to simplify and optimize payment and investment flows through AI agents.

Visa, for instance, is pioneering agentic commerce – AI agents that enable consumers to make purchases securely and seamlessly. Visa’s approach is poised to reshape global consumer behavior by delivering hyper-personalized, secure shopping experiences at scale.

And mobile-first broker Robinhood is developing an AI-powered investment assistant designed to provide real-time analysis, actionable insights, and curated market updates. The goal: elevate the personal investing experience by helping users navigate markets with greater precision and autonomy.

These innovations signal a wake-up call for neobrokers and money managing firms: embedding financial features is no longer enough. The future lies in combining financial services with AI-native solutions. Tools that offer individualized, proactive financial support through agentic systems are a must-have.

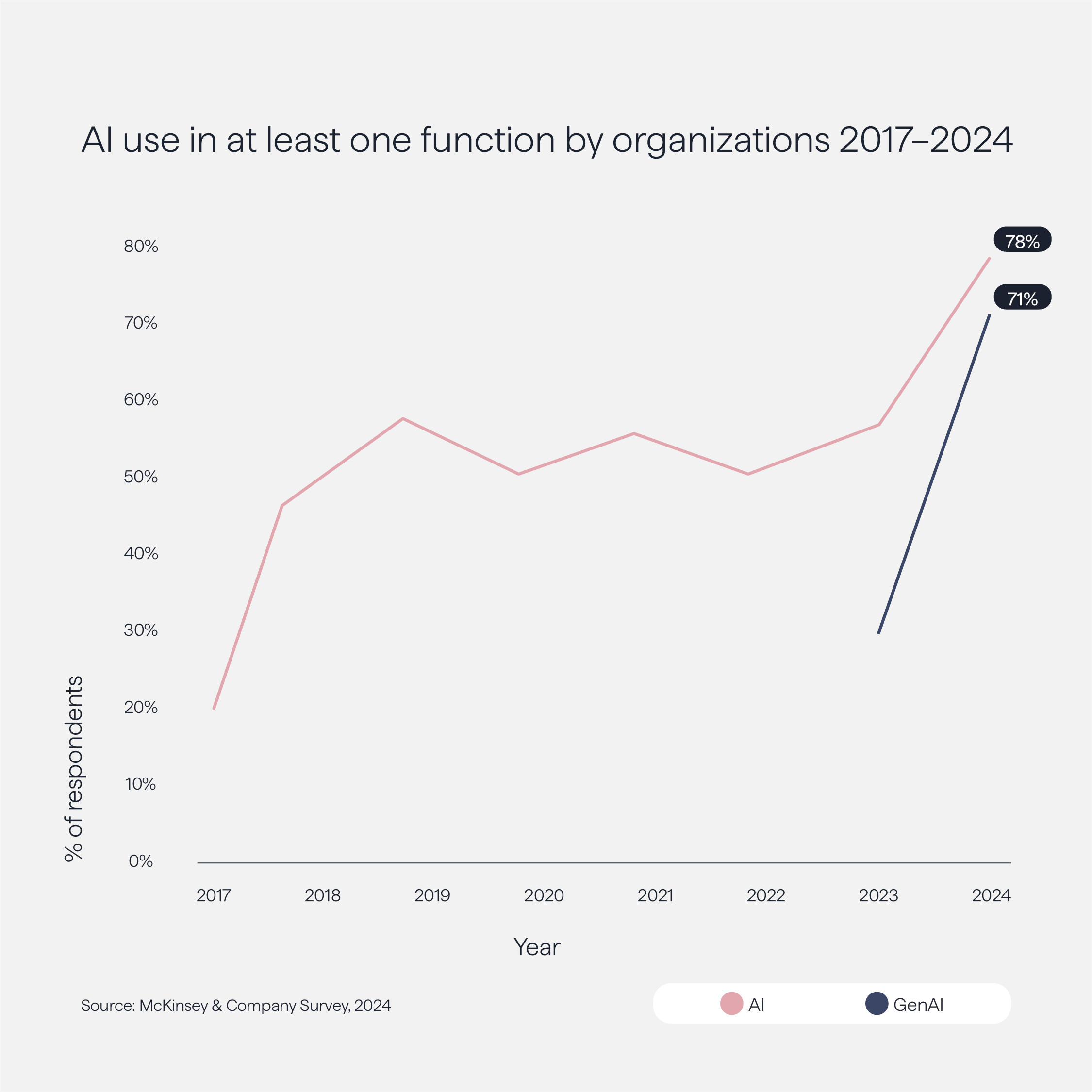

Case in point: It’s no surprise, then, that between 2023 and 2024, the number of companies globally using at least one genAI application rose by 71%.

Solaris’ unique position for genAI adoption

At Solaris, our digital-native architecture positions us uniquely for the next wave of genAI innovation.

Our modular API ecosystem and scalable cloud infrastructure provide a solid foundation for deploying genAI-powered solutions. Thanks to our data mesh architecture, essential data is readily accessible in our data warehouse. This already enables high-quality decision-making, planning, forecasting, and compliance workflows powered by AI.

We’ve established robust frameworks and governance models to ensure AI is implemented responsibly and in full compliance with regulatory requirements. Past learnings reinforce our commitment to safe, transparent genAI integration.

Looking ahead, Solaris and its partners are well-positioned to co-create agentic experiences. Our APIs can serve as “tools” within modern genAI agents, empowering partners to design personalized, embedded financial services.

In short, Solaris is ready to help shape the emerging agentic economy – one API at a time.

Watch the video and learn from Konstantin Kavvadias, CFO of Solaris, about the role artificial intelligence already plays at Solaris today – from customer support over process automation to the vision of a fully AI-based bank.

genAI solutions at Solaris

Today, Solaris has successfully integrated three advanced AI applications into its platform, fully adhering to regulatory requirements, directives, guidelines, and security measures.

At Solaris, we introduced a genAI-based ticket pre-processing feature for our customer support.

- This feature categorizes and summarizes incoming support requests and drafts initial responses for customer support agents. This solution significantly reduces risks by accelerating the processing of customer requests, delivering substantial cost savings, and decreasing manual workload.

For our seizures process, we transitioned to an genAI solution capable of automatically extracting and categorizing unstructured data from related documents.

- Before, Solaris relied on a legacy Optical Character Recognition (OCR) tool within a manual, multi-step seizure processing workflow. This AI-driven process enhances accuracy and efficiency, surpassing legacy OCR capabilities and delivering cost savings.

In the next step, we will implement automated document processing for Business KYC (KYB), enabling rapid and accurate extraction of relevant data from company documentation.

- The multi-step KYB process required manual extraction of data from various documents by analysts. This automation reduces document processing time dramatically – from four minutes per document down to just one minute.

The benefits of these three AI-driven automatization use cases are already visible.

Faster resolution of customer issues lowers the risk of regulatory interventions and complaints.

- genAI-based ticket pre-processing reduces dependence on human resources, enabling support teams to scale efficiently. Quicker responses boost customer satisfaction and retention.

Advanced AI-driven extraction for seizure processing delivers more reliable results than legacy OCR, reducing compliance risks.

- Streamlined workflows minimize manual intervention and improve operational efficiency, enhancing data integrity, reducing errors and rework, and lowering legal handling costs.

Automated KYB document processing allows onboarding more business clients without extra compliance resources.

- Enhanced accuracy and faster data handling improve auditability, reduce errors, accelerate onboarding timelines, enhance user experience, and speed revenue realization.

Elly Geck, Senior Product Owner at Solaris and part of our AI task force concludes:

“At Solaris we are transforming document processing from the core. LLM-based classification is used to turn raw documents — from KYB files to garnishment orders — into structured, high-confidence datasets ready for downstream post processing while still keeping a human in the loop. This is just one of the first steps for Solaris to become an AI first company, where AI is integrated into major processes to drive efficiency gains, improve compliance and proactively support fraud prevention.”

What partners can expect in the future

In the near future, we will integrate additional genAI-powered features into our platform.

At Solaris, we will use AI to fully automate core banking processes, fundamentally redefining operating standards and customer experiences. Our partners will benefit from these new features on the platform, and together we will become Europe's first AI-powered financial ecosystem.