How AI will change banking forever - Part 1

5 minute read

In 1997, George Clooney was People magazine’s Sexiest Man Alive, Steve Jobs returned to Apple, and the Spice Girls dominated pop music.

But another event occurred in New York City on May 11 this year that would reshape the world profoundly: IBM’s Deep Blue defeated chess Grandmaster Garry Kasparov.

Even better, IBM’s Deep Blue, an artificial intelligence (AI), made a move so unconventional and seemingly random that everyone watching burst into laughter, thinking it had malfunctioned.

But to everyone's surprise, a few moves later, the seemingly absurd strategy turned out to be a stroke of genius – Deep Blue had successfully set a cunning trap, leading to a surprising checkmate.

This seemingly nerdy event marked a turning point, demonstrating AI's capability to surpass human strategic thinking.

Fast forward to 2025, and AI – especially Generative AI (genAI) – is reshaping banking fundamentally, becoming central to embedded financial services innovation.

A brief history of Artificial Intelligence

Definition: Artificial Intelligence (AI) is machine-based intelligence, as opposed to natural human and animal cognition.

AI: from fiction to reality

We are quite familiar with the concept of an AI. Humans have long envisioned and sometimes feared intelligent machines.

This could be one of the reasons why reservations about the use of AI are relatively low – even in the financial sector.

Early depictions, such as Samuel Butler's 1872 novel Erewhon and the influential 1927 film Metropolis, show our fascination with machines mimicking human abilities.

The first practical robot appeared in Japan in 1929, equipped to exhibit facial expressions and movements.

And, Edmund Berkeley’s 1949 study, Giant Brains: Or Machines That Think, proposed the idea that machines could indeed process information and "think."

Berkeley comes to the conclusion:

"A machine can handle information; it can calculate, conclude, and choose; it can perform reasonable operations with information. A machine, therefore, can think."

AI milestones: from Concept to application (1950s-1960s)

In the 1940s and 50s, only a handful of scientists explored several research directions that would be vital to later AI research.

The 1950s saw critical developments, such as Alan Turing's foundational paper, Computing Machinery and Intelligence, and Marvin Minsky’s neural network machine (SNARC), laying the groundwork for AI research.

The field of "artificial intelligence research" was founded as an academic discipline in 1956.

In 1964, the first natural language understanding program was introduced, and by 1966, Shakey the robot became the first AI-driven robot capable of reasoning about its own actions.

From AI winter to mass adoption and genAI (1980-2025)

AI experienced significant setbacks – dubbed the "AI winter" – from the early 1970s through the early 1990s. AI development and research AI were characterized by funding cuts, end of serious research, a general pessimism about AI in the press, and the nearly total collapse of AI business.

Interest revived in 1995 with Richard Wallace's chatbot, A.L.I.C.E., and IBM’s Deep Blue victory over Kasparov in 1997.

AI’s development and capabilities expanded rapidly thereafter:

- 2002: iRobot's Roomba autonomously vacuums the floor while avoiding obstacles.

- 2004: Honda's ASIMO robot is able to walk human-like, delivering trays to customers in a restaurant.

- 2009: Google starts developing a driverless car.

- 2011: IBM's Watson computer defeated two Jeopardy! (television game show) champions.

- 2015: Google's DeepMind defeated three-time European Go champion Fan Hui by 5 games to 0.

- 2017: Transformer deep learning architecture was invented, which led to new kinds of large language models.

- 2018: Alibaba language processing AI outscores top humans at a Stanford University reading and comprehension test, on a set of 100.000 questions.

- 2022: ChatGPT, an AI chatbot developed by OpenAI, debuts in November.

- 2023: ChatGPT has more than 100 million users.

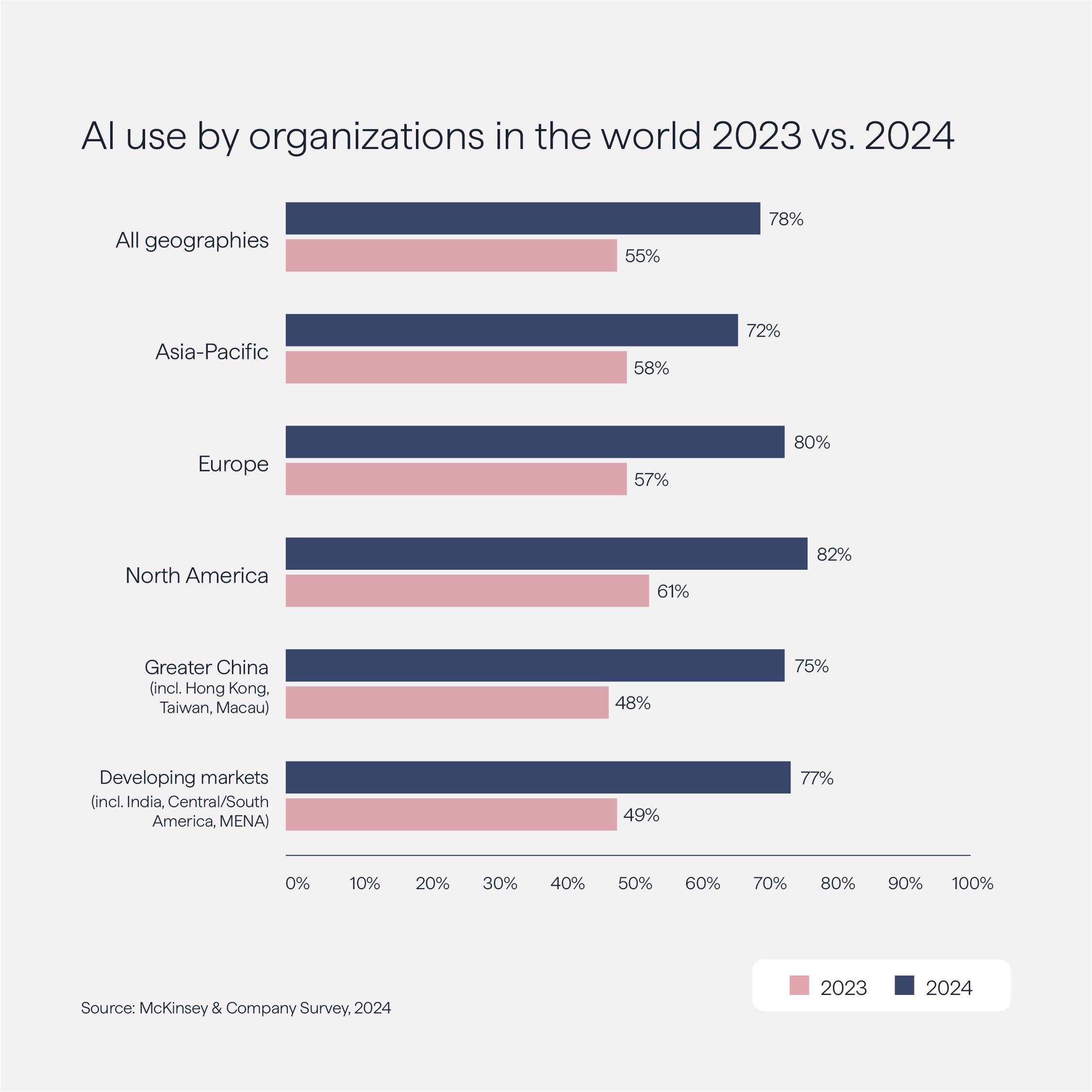

- 2025: 80 % of EU-based businesses use AI for daily operations.

AI in banking: market trends and outlook

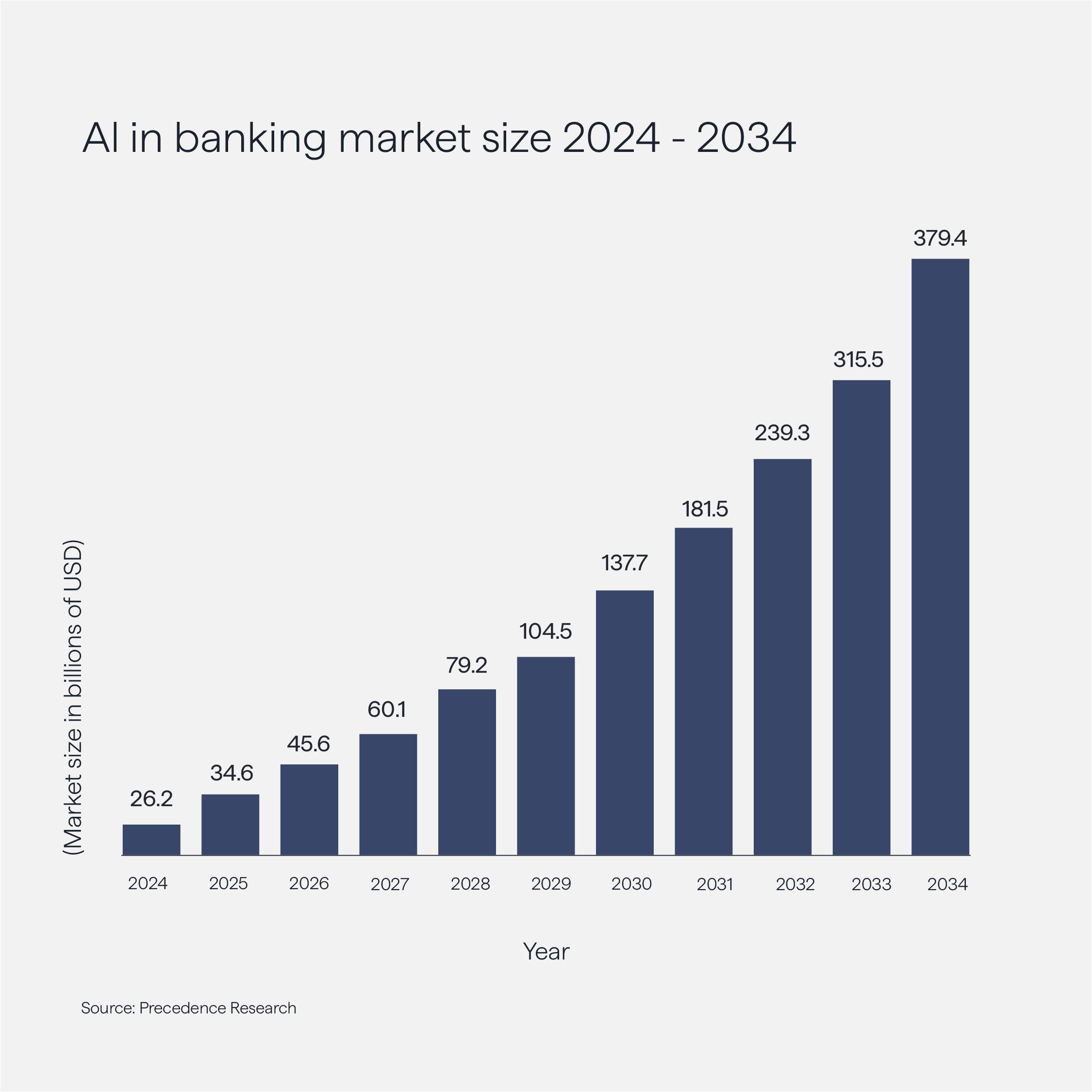

The global AI in banking market is experiencing explosive growth.

According to Precedence Research, the global AI in banking market will grow from USD 34.58 billion in 2025 to an estimated USD 379.41 billion by 2034, representing a CAGR of 30.63%.

A report published by CitiGroup in 2024 emphasizes that integrating AI technologies could enhance banking profitability by USD 170 billion (9% growth) by 2028.

Today, banks increasingly adopt AI to enhance efficiency, streamline operations, improve customer experiences, and combat fraud.

The integration of genAI and machine learning into banking operations helps institutions increase productivity, reduce operational costs, and address growing cybersecurity threats effectively. The adoption of genAI into banking processes is by far the biggest trend in the financial industry.

Additionally, rising customer demand for personalized financial services and data-driven decision-making further fuels the adoption of AI technologies.

How genAI is redefining banking efficiency

The emergence of genAI and Large Language Models (LLMs) since 2017 – especially following the public release of ChatGPT in 2022 – has profoundly reshaped the banking sector.

Within merely two-and-a-half years, genAI has driven significant improvements in operational efficiency, customer personalization, and security frameworks.

Banks increasingly leverage genAI capabilities to automate customer engagement via sophisticated chatbots, rapidly analyze extensive datasets for fraud detection, and deliver customized financial products to meet individual client needs.

Recent research by NTT Data underscores the rapid adoption of genAI within banking: by 2024, nearly 6 out of 10 banking organizations (58%) had fully integrated genAI technologies, up from just 45% in 2023.

A prime example of genAI’s impact is the deployment of advanced virtual assistants, capable of instantly addressing client inquiries and providing tailored financial advice. Such implementations not only enhance customer satisfaction but also significantly reduce operational costs, highlighting genAI’s pivotal role in driving innovation, service excellence, and profitability in the banking industry.

Elly Geck, Senior Product Owner at Solaris and part of our AI task force, sums up:

“AI is reshaping banking at its foundations – driving massive gains in operational efficiency, fraud detection, regulatory compliance, and customer support. For tech-driven companies, AI will also accelerate time to market by enabling engineers and product owners to use it for prototyping, development, and testing.”

The vision: AI-powered Banking-as-a-Service

Banking-as-a-Service, powered by advanced AI, will revolutionize traditional banking operations and make them hyper-efficient, secure, and deeply personalized.

The race is on to build or become the first fully AI-driven bank in Germany. This will be a game-changer for the finance industry.

With a growing market and the rapid adoption of AI in the financial services industry, it is only a matter of time before platform providers like Solaris incorporate AI on a large scale.

Asked about Solaris’ future role in the AI banking revolution, Vladimir Grigorev, Lead Commercial Data Projects at Solaris, says:

“We believe that Solaris will be the go-to partner for companies embedding banking products into their customer journeys and agentic workflows. We are closely monitoring how AI regulation within the EU unfolds, as this will be key to offering trustworthy and compliant banking products for the emerging AI economy.”

We predict that within the next five years, AI will play a substantial role in almost all banking operations.

Use cases will range from AI-driven fraud detection – which will significantly reduce financial crime and deliver unprecedented security – to AI-based language models and virtual assistants that empower bank employees by automating routine tasks. This will free employees to engage in strategic decision-making, enhance collaboration, and tackle complex financial challenges.

Beyond retail banking, AI-driven embedded finance solutions will transform B2B interactions.

Financial services will seamlessly integrate into business operations through advanced APIs and real-time AI analytics, enabling automated credit decisions, optimized cash flow management, and instant fraud detection.

This visionary AI-based ecosystem will redefine banking and finance, merging human creativity with artificial intelligence to set new standards for operational excellence and customer-centric innovation.