Driving into the future: How Solaris helped ADAC build a smooth, secure, and scalable credit card program

5 minute read

Data migration projects are always challenging. But when the project involves the details of 1.1 million credit cards issued by Europe's largest car club, the stakes are as high as they'll ever get.

The process is extremely complex, involving multiple parties and many moving parts. More to the point, should something go wrong, the consequences would be exceedingly costly from both a financial and reputational perspective.

Which is why, when Solaris won the project for ADAC's credit card migration through an RFP (request for proposal), they took a carefully structured and methodical approach.

ADAC SE: Powering mobility through financial services

Founded in 2016, ADAC SE emerged from ADAC e.V. to manage the commercial and financial operations of the ADAC Group.

It offers a wide range of mobility-related services and products to ADAC members, non-members, and B2B customers alike.

ADAC SE oversees a network of 25 affiliated companies and private equity firms, including:

- ADAC Versicherung AG – insurance services

- ADAC Finanzdienste GmbH – financial solutions

- ADAC Autovermietung GmbH – car rental services

- ADAC Service GmbH – mobility and support services

As a growth-oriented and innovative market player, ADAC SE is leading the way in digital transformation across all its business areas. The company continuously invests in future technologies and drives innovation to meet evolving mobility demands.

The credit card program of the ADAC, which it initially launched in partnership with Landesbank Berlin, gives holders access to various perks, including discounts on car rentals, fuel purchases, hotel stays, and other leisure activities, travel insurance, and free cash withdrawals.

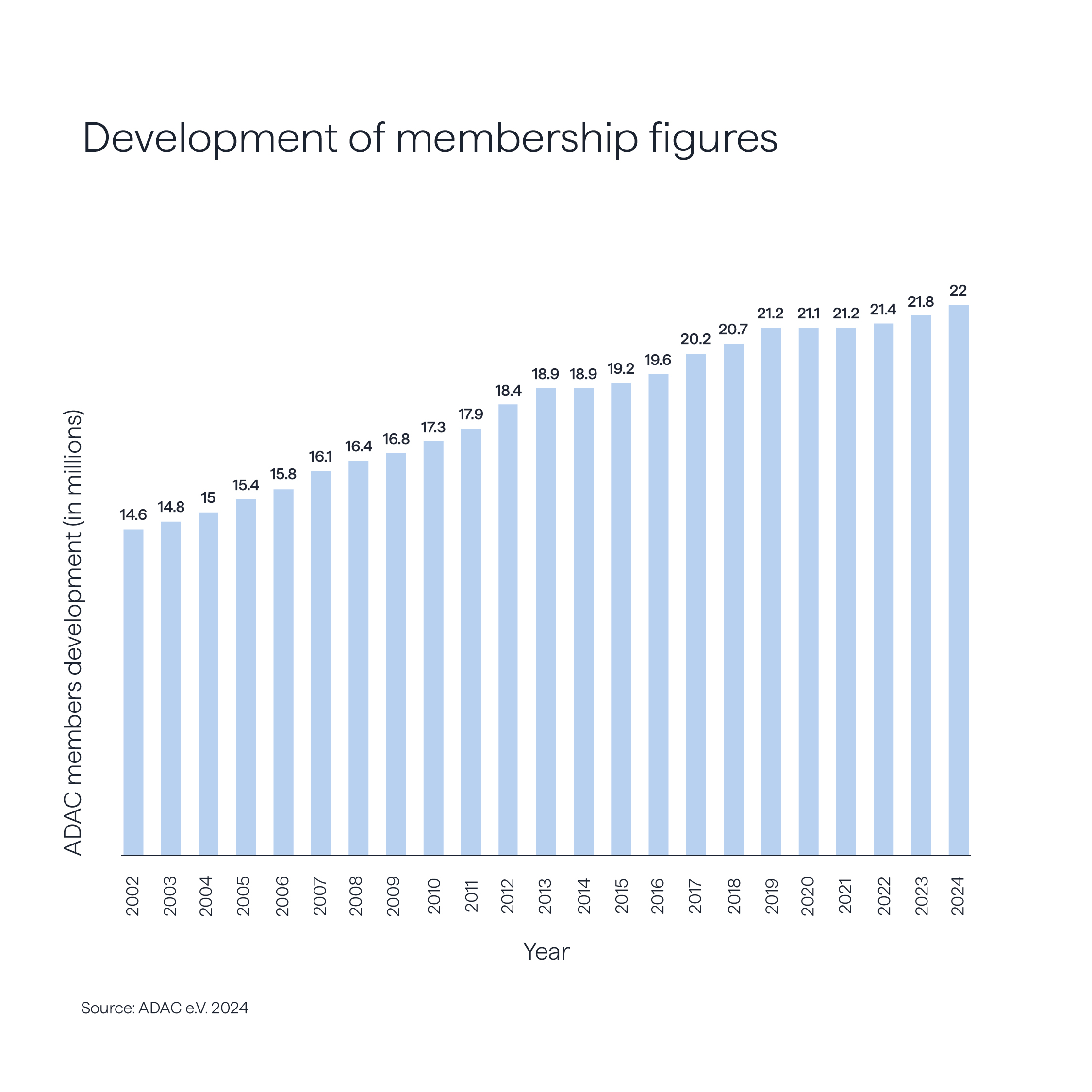

By the time ADAC SE selected Solaris as its new partner, in 2022, the program had grown significantly. The portfolio which Solaris had to migrate included around 1.1 million cards: the largest project we'd been involved in to date.

An itinerary for expansion: New ambitions for the credit card

Migrating the huge amount of data generated by 1.1 million credit cards securely, without causing noticeable service disruption, is a significant undertaking in itself.

But the financial unit of the ADAC had bigger ambitions for the project beyond simply switching banking partners while maintaining the same level and quality of service. Specifically, they wanted to:

- Modernize the program and enhance its capabilities

- Provide a more feature-rich, digital-first customer experience

- Build a solid foundation for future growth

The latter in particular was one of the key reasons Solaris stood out. To meet ADAC's ambitions, while minimizing disruption and maximizing data security, Solaris divided the project into two distinct streams on which they worked in parallel: a migration stream, and a product development stream.

As the name suggests, the teams involved in the migration stream focused exclusively on transferring customer data from Landesbank Berlin to Solaris. Meanwhile, the product development team built an end-user platform for the credit card holders, including a web portal and iOS and Android apps.

All change: Executing the data migration

To make the process as smooth and seamless as possible, Solaris migrated the data from Landesbank Berlin to its systems in six stages. Each of these stages served as a sort of "dress rehearsal."

Uzair Anwar, who – at the time of the project – was a software architect, and is now Solaris' Director of Engineering, explains:

"Every end-to-end 'dress rehearsal' involved all the stakeholders, in order to validate the migration plan and ensure seamless execution. This proactive approach helped us avoid last-minute surprises and ensure a smooth transition."

Solaris also provided a sandbox environment that mirrored the production setup.

Anwar continues:

"We ran each 'dress rehearsal' in our sandbox environment. This made it possible for us to simulate the migration multiple times in a production-like setting without impacting live systems. As a result, we were able to test and fine-tune the process as thoroughly as possible with minimal risk."

The migration team still had to contend with significant challenges.

Aside from the project's sheer scale, multiple parties were involved: Landesbank Berlin, the source of the data, card processor Nexi, and, of course, Visa and MasterCard. And longtime partner Netguru developed middleware that connected mobile and web apps with Solaris’ API. For the outcome to be successful, all the parties had to coordinate and collaborate closely.

Crucially, the data itself was not only highly sensitive, but also extremely complex to manage.

This is how Anwar describes the complex process of migrating credit cards to the Solaris platform:

"Data mapping was a significant challenge, due to the fundamental differences between the two systems and their underlying architectures.

This is the case with any large scale data migration project. The data was provided in the format native to Landesbank Berlin's systems. We had to carefully map this data and transform it so it would align with Solaris' platform while ensuring accuracy, consistency, and seamless integration across all systems.

"The volume we were dealing with complicated matters. We had to develop extensive documentation in collaboration with Landesbank Berlin and Nexi, which we then had to check and verify, before we could even think about starting the actual migration."

Breaking new ground

While the migration team were working hard on mapping the data, creating and testing the processes required, and carrying out the actual transfer, the product development team were focused on the technology platform.

This was the first time Solaris built a fully end-to-end offering designed for end-users (in this case, ADAC credit card holders). And, given the scale, it was a baptism of fire.

But the scope and scale of the project also represented a turning point.

"It was transformative for us," says Anwar. "Through it, Solaris' offering evolved from API-based products for partners, to comprehensive banking applications delivered directly to end-users."

So how did the product development team approach building the end-user platform?

"We conducted a thorough analysis of Landesbank Berlin’s existing application and held several in-depth brainstorming sessions with ADAC to finalize the feature set for our platform," explains Anwar.

The goal wasn't just to develop an app with the same exact features as the existing one. ADAC’s financial unit also wanted to be able to offer additional services and, just as important, have enough flexibility to grow the business, venture into new verticals, and be responsive to market changes and shifts in consumer expectations.

With this in mind, the ability to adapt and scale easily were critical to the project's success.

From Solaris' perspective, we also wanted to be in a position where we'd have a more comprehensive offering that all our clients and partners could benefit from moving forward.

"Getting this project right meant that, in future, we could take on similar projects of this magnitude without having to start from scratch," says Anwar. "This would dramatically cut development time and enable us to continuously make incremental improvements and enhancements."

The road ahead: What's next?

It took two years — incidentally, Solaris' proposal specified a delivery timeframe of around 1.5 years, which means the project didn't go far off track despite its scale, scope, and challenges — and lots of hard work.

But the results are undoubtedly worthwhile, particularly because the platform is built with the future in mind, on infrastructure that's capable of handling a growing number of users and an expanding product lineup without impacting performance or compliance.

Now that the platform's live, the team is working on product-level enhancements and improvements.

And the lessons learned and capabilities acquired from this project will benefit all the clients on Solaris' books.

"We've literally eaten our own dog food," concludes Anwar, "That is to say, we treated ourselves as our own partner, building a complete solution from the ground up using the APIs that we offer to all our existing partners.

"Moving forward, this puts us in a position where we can offer a wider breadth of functionality than ever before, and an even higher level of service to all our clients."